In March 2014, the Obama Administration released its ‘Climate Action Plan’ laying out a comprehensive, interagency strategy to cut methane emissions. The purpose of this plan is to help meet the president’s goal of reducing total US greenhouse gas emissions 17% below 2005 levels by 2020. In particular, the plan stresses the need for new actions to reduce methane emissions, stating: “Today, methane accounts for nearly 9% of domestic greenhouse gas emissions. And although U.S. methane emissions have decreased by 11% since 1990, they are projected to increase through 2030 if additional action is not taken.” The plan quantifies this increase by estimating “a level equivalent to over 620 million tons of carbon dioxide pollution in 2030.”

Based on the draft 2014 GHG Inventory numbers, among industrial sources of methane emissions natural gas systems lead the way with 23% of the total – more than double the contribution of the coal mining sector (10%). In the wake of an assumed continuous shale gas boom made possible by hydraulically fractured well completions, those emissions are only expected to increase further. Here, the plan provides further details on the natural gas industry: “In 2012, 28% of methane emissions were attributed to the oil and natural gas sectors. Methane equivalent to 127 million tons of carbon dioxide pollution was emitted from production, processing, transmission, storage, and distribution of natural gas. (…) Within the natural gas industry, approximately 31% of this methane came from production sources, 15% from processing, 34% from the transmission and storage, and 20% from distribution.” In addition, a recent study published in the journal Science found that the EPA may be underestimating methane leakage rates from oil and natural gas production and distribution by 25 to 75%.

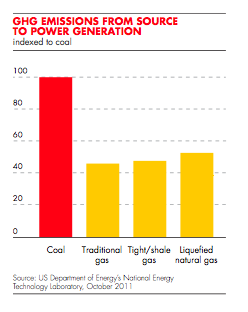

Natural Gas Compared to Coal Across Life Cycle

All these data points, findings and climate initiatives may come at a bad time for prospective US LNG exporters that hope to get through a current bottleneck in the regulatory approval process – namely, the FERC process as identified in a previous article – as soon as possible given that time is of the essence in a competitive global LNG market. Conversely, environmental groups may be heading towards better times given that ‘fracking’ and methane emissions draw more public scrutiny and may dominate the headlines in a post-Keystone XL environment. Unsurprisingly, LNG export projects are thus coming under increasing pressure from environmental groups, which are likely to mount more legal challenges. Keep in mind, that states are the primary regulators of many aspects of oil and gas production activities as well as the distribution of natural gas. Questions focus on the local environmental impact and the cumulative emissions of developing shale gas, along with pipeline and shipping infrastructure to liquefy natural gas and ship it overseas.

At this point, Cheniere Energy’s case becomes very instructive because it is to date the only project that has obtained approval from both DOE and FERC. All other DOE-approved projects are awaiting authorization from FERC. In May 2011, DOE granted long-term authorization under section 3 of the Natural Gas Act (NGA) and the Commission’s regulations to site, construct, and operate facilities for the liquefaction and export of domestically produced natural gas at the existing Sabine Pass LNG terminal to non-FTA countries. It is highly relevant that this specific terminal had obtained regulatory permits before. Back in 2004, FERC granted Sabine Pass LNG authorization under section 3 of the NGA to import foreign-sourced LNG. In 2006, FERC granted permission to Sabine Pass LNG to increase the terminal’s send-out and storage capacity.

What stands out in Cheniere Energy’s case relating to its Sabine Pass LNG export terminal section 3 authorization is that FERC opted for a ‘shorter’ environmental assessment (EA) of the project instead of a full environmental impact statement (EIS), as has been demanded by environmental groups. FERC concluded that its approval of the Sabine Pass LNG project would not constitute a major federal action significantly impacting the quality of the human environment, and, consistent with Council of Environmental Quality (CEQ) regulations, no EIS was required as a consequence.

In general, the CEQ regulations require government agencies to consider the environmental effects (40 C.F.R. § 1508.8) of proposed actions – i.e. projects, including: (a) direct effects, which are caused by the action and occur at the same time and place; and (b) indirect effects, which are caused by the action and are later in time or farther removed in distance, but are still reasonably foreseeable. Moreover, agencies are required to consider the cumulative impacts (40 C.F.R. § 1508.7) of proposed actions defined as “the impact on the environment which results from the incremental impact of the action when added to other past, present, and reasonably foreseeable future actions.” Looking closely at the responses FERC gave in its final order to some of the major arguments raised by environmental groups during the comment period may offer valuable insights as to whether FERC’s decision to ‘waive’ an EIS for Sabine Pass stands as a precedent in handling other pending LNG export applications.

Most importantly, FERC determined that the shorter EA was appropriate because all proposed facilities would be located at an already existing LNG terminal, previously already the subject of an EIS. The EA then concluded that the liquefaction project would not have a “significant impact” on the quality of the human environment. In particular, FERC reasoned that any impacts which may result from additional domestic natural gas production were not “reasonably foreseeable” as defined by the CEQ regulations and thus did not need to be considered in a cumulative impacts analysis and/or addressed in the EA. In this respect, FERC specifically noted that “at the time of issuance of the EA, certainty that all of these projects [on the Gulf Coast] will proceed [and contribute to air emissions and greenhouse gases] is speculative.” Undeniably, FERC is correct in basically making the argument that any future overall increase in domestic shale gas production may occur for a variety of reasons and, thus, cannot be attributed to a specific LNG export facility – legally due to the lack of a ‘genuine link’.

The main takeaway from the Sabine Pass FERC approval is that regulators have not considered in their decision-making any indirect and/or cumulative effects of US LNG projects – in their words, “speculative” because “not reasonably foreseeable” – simply because they were able to sidestep a real evaluation on merits by pointing to an EIS as part of a previously granted approval. However, calling those potentially harmful environmental effects ‘speculative’ does not mean that they are not real.

Consequently, LNG projects sited at an already existing (‘brownfield’) LNG terminal may hold a twofold advantage over their domestic competitors in the FERC approval process: an EIS as part of a previously granted approval in addition to a general first-mover advantage – see Sabine Pass LNG project – in the sense that only LNG projects down the processing queue will face the ‘indirect and/or cumulative effects’ assessment with potentially adverse implications. In addition, those ‘latecomer’ LNG projects are therefore far more exposed to successful legal challenges by environmental groups. And the FERC process – what looked like a bottleneck initially – may turn out to be a ‘regulatory black hole’ for them. We may see the early beginnings of environmental considerations in terms of global climate change and the upstream methane emissions setting an eventual limit on LNG exports and projects. In this context, Michael Oppenheimer, Professor of Geosciences and International Affairs at Princeton University, notes in an essay for the Scientific American Forum that President Obama’s ”methane strategy” constitutes “a first step toward comprehensive regulation [and that] this federal rule-making on methane leakage is in the interests of both the nation and the global climate system.” Better understanding of methane emissions will also determine whether natural gas remains President Obama’s best friend or joins the ranks of outcast coal.