Today the US Energy Information Administration slashed its 2015 oil price forecasts, but the statistical arm of the DOE still expects total oil output to increase to volumes not seen since 1972. As we reported last week, it will take some time before current lower oil price levels manifest in lower US oil production volumes.… Keep reading →

Adam Sieminski

Sign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Energy News Roundup: Private Equity ‘Salivating’ Over Energy, Sieminski’s 5 Energy Takeaways & Rooftop Solar Could Hit Investors

By Jared AndersonThe knock-on economic opportunities associated with developing, transporting and consuming energy are widespread and have drawn eye-popping amounts of private equity investment in the past few years. “That opportunity has the private equity industry salivating. PE funds have raised $157 billion since 2009 to invest in energy, according to data from intelligence firm Preqin. And… Keep reading →

Energy Quote of the Day: ‘Texas & North Dakota Now Account for Almost Half of Total US Oil Production’

By Jared AndersonThe EIA’s latest Short-term Energy Outlook is out and US crude oil output continues to soar, while natural gas prices are expected to climb back toward the $5 per million BTU level this year, before slightly pulling back in 2015. EIA Administrator Adam Sieminski highlighted just how prolific US crude oil production has been in… Keep reading →

Energy Quote of the Day: Sieminski on US Gas Exports – Freight Trucking and Alaska Notable

By Jared AndersonIn yesterday’s Senate Energy and Natural Resources Committee testimony, EIA Administrator Adam Sieminski said US natural gas looks poised for significant export growth over the next 25 years – via both pipeline and LNG – but numerous indigenous and exogenous factors could alter that outlook. The answer to the hearing’s question-phrased title – “Importing Energy, Exporting… Keep reading →

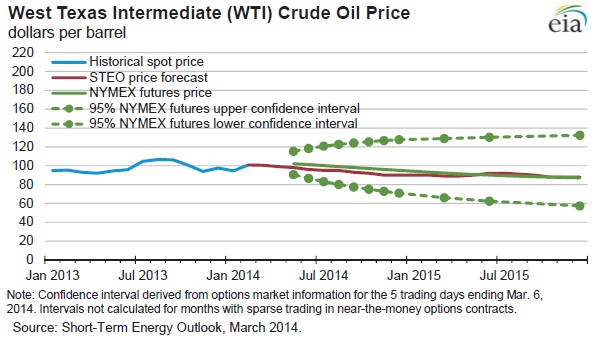

The US Energy Information Administration – DOE’s statistical arm – today released its Short-Term Energy Outlook, which includes commodity price forecasts and anticipated supply/demand fundamentals. Included below are some comments from EIA Administrator Adam Sieminski about the report: Crude Oil “EIA expects strong U.S. crude oil production growth will help reduce WTI prices to an… Keep reading →

The Short-term Energy Outlook is the EIA’s periodic analysis of where energy fundamentals appear to be heading based on current data and assumptions. The reports cover supply/demand dynamics and pricing for oil, natural gas, refined products, coal, power, renewables, emissions and the US economy. This edition of the EIA’s STEO – released earlier this week… Keep reading →

The head of the US Energy Information Administration Adam Sieminski spoke about a wide range of issues at an event in New York earlier this week, including the US Winter Fuels Outlook, the new drilling productivity report, the geopolitics of shale development, EIA’s International Energy Outlook, and he provided insight into the rapidly-developing technologies used… Keep reading →

As the developed world enjoys an energy production renaissance, developing countries – particularly in Asia – look to lead global energy consumption growth and are expected to burn lots of coal along the way. The US Energy Information Administration Thursday released its International Energy Outlook that forecasts energy balances and consumption trends out to 2040.… Keep reading →

Ron Wyden, Democratic Senator from Oregon and Chairman of the Senate Committee on Energy and Natural Resources, grilled oil market experts today on why US consumers are not benefiting from higher US oil production via lower gasoline prices at the pump. Those experts indicated that whether or not they are aware of it, US consumers… Keep reading →