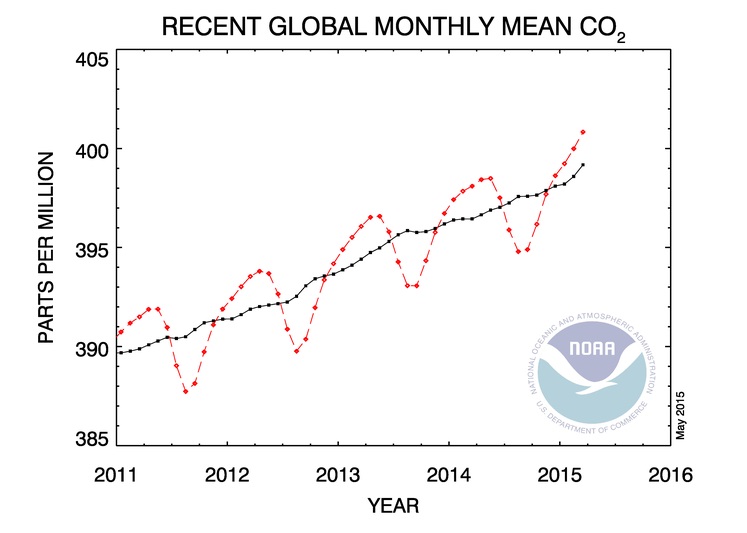

The monthly global average concentration of carbon dioxide in the atmosphere surpassed 400 parts per million in March for the first time since record keeping began. “This marks the fact that humans burning fossil fuels have caused global carbon dioxide concentrations to rise more than 120 parts per million since pre-industrial times,” added Tans. “Half of that rise has occurred since 1980.” [NOAA]

FORT MCMURRAY, CANADA – APRIL 27: The Syncrude oil sands site, on April 27th, 2015 outside of Fort McMurray, Canada. Fort McMurray is currently coping with an economic downturn as a result of low oil prices and most of the layoffs have been impacting the transient workforce. Canada’s oil and gas industry is expected to lose 37% of its revenues in 2015. (Photo by Ian Willms/Getty Images)

The Progressive Conservative party in Alberta, Canada has been voted out of office for the first time in over 40 years. The energy industry is watching closely as the newly elected New Democratic Party is expected to be less friendly to oil and coal business interests. “NDP has pledged to review royalty contracts, raise corporate tax by 2% and phase out coal-fired power generation that observers feel would raise cost of business in the province which is already reeling from a 50% decline in crude oil prices. The party has also said that it will not promote the Northern Gateway and Keystone XL pipelines.” [Financial Post]

For the last time people, the oil futures forward price curve is not a forecast! Startlingly, some policymakers still mistakenly look to the oil futures market as an indicator of what spot prices will be at a future date. “Forward prices have been used extensively in macroeconomic models used by central banks and other official agencies. But even a cursory review of the forward curve’s behaviour in recent years shows forward prices have been very poor predictors of realised spot values. And the reason why futures are so poor at forecasting is because the forward curve shows the price at which it is possible to buy or sell futures contracts for a forward date at a price agreed today.” [Financial Times]