While the current focus is on declining oil prices – which hit four-year lows yesterday – the longer-term oil market picture could feature downward supply pressure and a demand surge that forces prices right back up, according to IEA’s flagship World Energy Outlook 2014. The agency cautions against allowing current supply/demand fundamentals to breed complacency.… Keep reading →

Oil Supply

Energy Quote of the Day: ‘A Well-supplied Oil Market in the Short-term Should Not Disguise the Challenges…’

By Jared AndersonSign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Benchmark oil prices took a nose dive today, with both WTI and Brent shedding their recent gains. Prompt-month WTI dipped into $75 per barrel territory on a combination of weak economic outlooks and supply/demand fundamentals. The other big news impacting WTI was Saudi Aramco’s price cut to the crude oil grades it exports into the… Keep reading →

With all eyes on the global crude oil market due to recent price declines, analysts and investors are frantically searching for the bottom, with some expecting a continued plunge. While there could still be some short-term volatility and downward pressure, Barclays’ analysts see oil prices strengthening by mid to late 2015. Crude oil futures prices… Keep reading →

Energy News Roundup: Only the Saudis Know, Texas: What Me Worry? And Divestment Discussion Amid Lower Oil Prices

By Jared AndersonIn one of the more honest assessments of current Saudi Arabian oil policy, Rice University’s Jim Krane said there are several plausible reasons behind the Saudis’ apparently sanguine approach to falling global oil prices, but only a few within the Kingdom really know. “If you’re somebody who looks at geopolitics and energy, you could come… Keep reading →

Energy News Roundup: Is Opec Toothless? Hedge Fund to Buy Hess Energy Trading & Sasol Approves $8.1B Ethane Cracker

By Jared AndersonThis article reevaluates Opec’s power to control the global oil market and focuses on a political scientist’s research that suggests the cartel’s strength has been overblown for years. “But a closer look at OPEC’s real influence over the oil market suggests that we’re making a huge mistake about its global power, says Brown University political… Keep reading →

Energy News Roundup: Ethanol Decreased US Gasoline Energy Content, $50B Midstream Merger & Neutral Zone Oilfield Shut

By Jared AndersonAs the volume of ethanol blended into the US gasoline supply increased from 3% to 10% over the past two decades, the fuel’s energy density decreased by 3%, according to the EIA. In an interesting example of how energy/environmental issues are often characterized by tradeoffs, greater volumes of ethanol added to gasoline decreases air pollution… Keep reading →

Energy Quote of the Day: ‘The Big News in the Oil Markets is Not Just Lower Prices…’

By Jared AndersonThe downward trend in global oil prices that garnered so much attention – and hyperbole – over the past couple of weeks also revived interest in the US crude oil export conversation. The million dollar question with regard to US oil exports is how additional volumes of US crude on the global market would impact… Keep reading →

Alarmist media reports regarding oil’s foray into bear market territory could easily leave you thinking the oil industry is gasping its last breath. It certainly is not, as companies involved in the global oil complex are accustomed to commodity price volatility and most have experienced similar, if not worse, market corrections. In fact, over the… Keep reading →

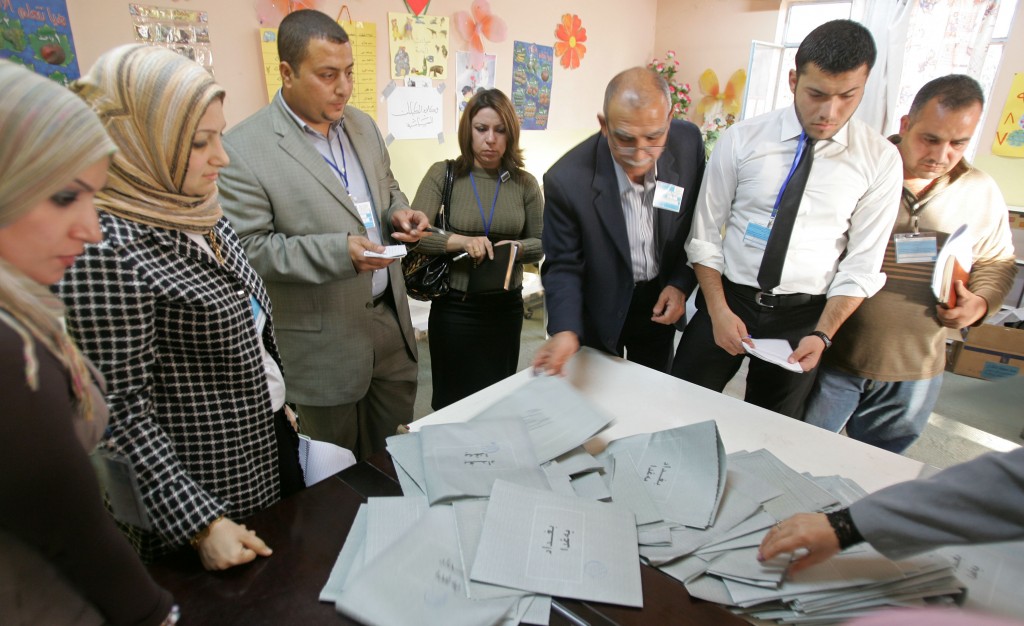

How (Geo)Political Stability Traded for ‘Messy’ Democracy in the Middle East Hinders Energy Market Interconnectivity

By Roman KilisekMajid Jafar, CEO of Crescent Petroleum, suggests in an article titled “What can the Middle East learn from the US shale boom?” three ways for regional policymakers to bring interconnectivity to the Middle East’s oil and gas market as well as accompanying infrastructure. These steps are intended – in his words – to “unleash a… Keep reading →

Energy News Roundup: Credit Suisse Cuts Oil Price Forecast, Gazprom’s Gas Exports Down & Oklahoma Wind Power Controversy

By Jared AndersonAnalysts at investment bank Credit Suisse cut their 2015 benchmark global oil price expectations in the face of bearish fundamentals, forecasting Brent to average $97 per barrel and WTI to average $89/bbl. All eyes are on Saudi Arabian exports, which are currently at the lower end of the historical spectrum and could decrease further when… Keep reading →