As the Mexican government and state-run PEMEX aim to produce more oil in Mexico, U.S. natural gas producers, particularly in South Texas, have been happy to send growing amounts of natural gas to supply Mexico’s growing demand.

Figure 1 Source: BP Statistical Review

Because the U.S. is producing record volumes of natural gas, access to a growing market of consumers has been a godsend for U.S. producers. As more gas enters the market, producers have been cautious of oversupply and potential glut. With Mexico bordering Texas, a steadily-growing natural gas producer, pipeline exports of gas from Texas have surged since 2011.

Figure 2 Source: Energy Information Administration

The U.S. natural gas that is delivered to Mexico has been sourced from throughout the Gulf Coast, with significant volumes from the Eagle Ford Shale. In July, Columbia Pipeline LLC filed an application with FERC to construct a border-crossing pipeline that would ship Eagle Ford Shale natural gas to Mexico. If approved, the pipeline would send about 1 Bcf/d of Eagle Ford gas to Mexico. Columbia Pipeline’s projections are partly based on EIA forecasts that natural gas demand in Mexico will double from 2012 levels by 2017. As shown in the graph above, much of Mexico’s recent demand has been supplied by the U.S. The EIA also predicts that by 2018, U.S. pipeline exports will reach 3.8 Bcf/d, or almost double U.S. pipeline exports to Mexico in 2013.

Figure 3 Source: Energy Information Administration

From a public relations perspective, identifying new customers for Eagle Ford Shale natural gas couldn’t have come at a better time for producers. The San Antonio-Express conducted an excellent investigation into flaring within the Eagle Ford Shale play and found the rate of Eagle Ford flaring was 10 times higher than the combined rate of the state’s other oil fields. In addition, the total volume of wasted gas in the Eagle Ford Shale from 2009 to 2012 was almost 39 billion cubic feet — enough to meet the annual heating and cooking needs for all 335,700 local residential customers.

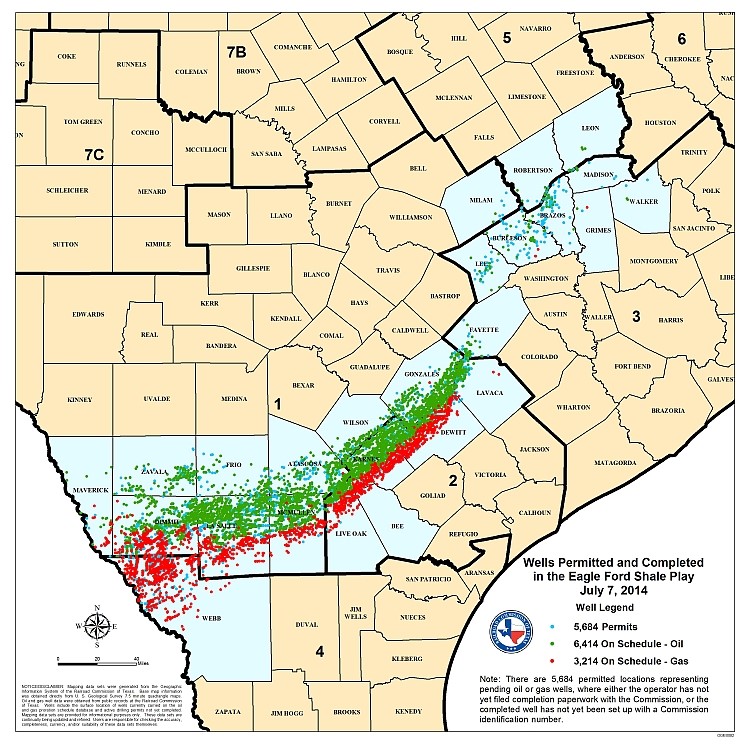

Figure 4 Source: The Texas Railroad Commission

Another explanation for rising natural gas production is associated gas. (Associated gas, as it sounds, is natural gas found in association with oil, either dissolved in the oil or as a cap of free gas above the oil.) The map above gives an overview of completed oil and gas wells in the Eagle Ford Shale Play. Notice that there are nearly twice as many wells drilled for oil as for gas. In February, Barclays Capital issued a note on the Eagle Ford, concluding that no matter what type of well is being completed in the formation, a lot of natural gas is coming with it. Barclays stated, “In the Eagle Ford Shale play, an ongoing shift to drilling for oil has not translated into natural gas production declines. Instead, well-level data show that associated gas production has overtaking gas-well gas in driving the play’s output higher.”

Consulting firm Wood Mackenzie published an analysis in June predicting that by 2020 Eagle Ford Shale Crude could reach 2 million barrels of oil per day. If Eagle Ford Shale Crude output is anywhere close to this figure, expect a lot a natural gas to follow.