All eyes in the US oil market are currently focused on the small town of Cushing, Oklahoma, located 70 miles northeast of Oklahoma City. Available capacity at one of the world’s largest crude oil storage hubs is filling up fast and that has considerable market implications because Cushing is the delivery point for US benchmark… Keep reading →

Oil Prices

‘Pipeline Crossroads of the World’ Holding Billions in Black Gold, Fueling Oil Storage Trade

By Jared AndersonSign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Bulging inventories are expected to continue to build at the biggest US oil-storage facility, putting more downward pressure on crude prices and adding to calls on the federal government to legalize exports, analysts said. The amount of oil stored at the Cushing Hub in Oklahoma rose to 48.18 million barrels in the week ending Feb.… Keep reading →

Over the past few months, with oil prices at historical lows, China imported more oil than it needed, putting extra capacity into storage and boosting monthly imports to a high of 7.2 million barrels per day in December. According to price reporting agency Platts, around 300,000 barrels per day were likely earmarked for commercial storage… Keep reading →

Oil Import Dependence not Aways Economic Disadvantage, Study Finds

By Roman KilisekMerry go round. Credit Shutterstock According to research by the Cologne Institute for Economic Research (Institut der Deutschen Wirtschaft Koeln) energy imports should not be “understood as a threat to the security of energy supply and an economic disadvantage” per se. The study – “Does Dependency Equal Vulnerability? Energy Imports in Germany and Europe” commissioned… Keep reading →

Energy Quote of the Day: Did I Miss Where it Said There Will be Zero Demand for Oil by 2050?

By Edward DodgeSaudi Arabia’s oil minister is concerned about potentially disruptive trends that could undermine the oil industry in the coming decades. New technologies and efforts to cut carbon emissions offer potentially existential threats to the world’s most important commodity. Current projections from the IEA and other analysts all forecast demand for oil increasing, with medium-term forecasts… Keep reading →

What time is it? Credit: Shutterstock Many analysts agree that as US oil companies pullback capital spending, lay down rigs and drill fewer new wells, production will inevitably decline, supply and demand fundamentals will rebalance and oil prices will increase. But that’s where the agreement ends. International benchmark crude oil prices have recovered a bit… Keep reading →

Energy Quote of the Day: Rig Count Offers Little Insight into the Outlook for US Oil Production Growth

By Edward DodgeUS oil production continues to improve despite the recent drop in oil prices and a declining rig count. The reason? Improved drilling productivity, particularly in shale. “The headline U.S. oil rig count offers little insight into the outlook for U.S. oil production growth,” Goldman Sachs Group Inc. analyst Damien Courvalin wrote in a Feb. 10… Keep reading →

Energy Quote of the Day: ‘Forget Oil (for Now); US Gas Market More Structurally Challenged’

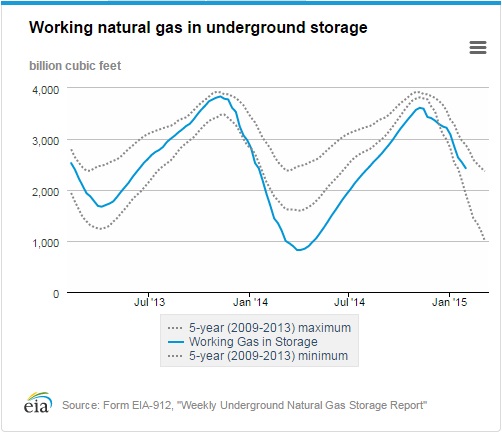

By Jared AndersonWith all eyes focused on falling oil prices for the past several months, the US natural gas market has often been overlooked. Not that it has done much from a price movement perspective in the past couple of years. Another cold blast of Arctic weather is headed for the Midwest and Northeast over the next… Keep reading →

Energy News Roundup: Coal Divestment, Oil Production Deficit and Venezuelan Economy Struggling

By Conor O'SullivanThe world’s richest sovereign wealth fund severed ties with 32 coal mining companies, removing them from its portfolio in 2014, based on the risk of facing regulatory action on climate change. “Norway’s Government Pension Fund Global (GPFG), worth $850bn (£556bn) and founded on the nation’s oil and gas wealth, revealed a total of 114… Keep reading →

Energy Quote of the Day: ‘The Lower Oil Price is Bringing More Deflationary Pressure’

By Edward DodgeCheaper oil has not been translating into economic growth over the last six months and falling oil prices have also stoked deflationary fears. Some countries have been using the drop in oil prices as an opportunity to raise gasoline taxes, slash fuel subsidies or both. China has raised fuel consumption taxes by 50% since November,… Keep reading →