The revised Master Limited Partnerships Parity Act would allow renewable energy projects to access financing and tax advantages that are currently available only to fossil fuel energy projects.

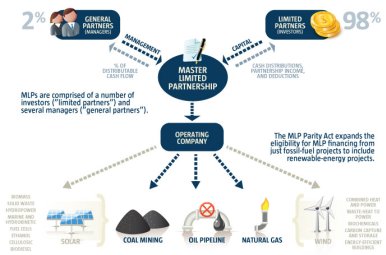

On April 24, 2013, a group led by Sen. Chris Coons (D-Del.) introduced an expanded version of the Master Limited Partnerships Parity Act introduced in 2012 to allow renewable energy projects to access master limited partnerships (MLPs), which are currently available only for initiatives involving oil, gas, coal, and pipelines. The legislation, which aims to benefit the emerging renewable energy sector, would provide a level financing system and tax treatment for renewable energy and fossil energy projects. The expanded version provides greater clarity of legislation implementation and opens up MLPs to initiatives involving energy efficient buildings, power production from waste heat, bio-chemicals, and carbon capture and sequestration.

MLPs create a business structure that leverages tax advantages of a partnership while ownership interests are traded similar to corporate stock. The investors, called limited partners, provide capital and receive quarterly dividends, while the managers, called general partners, oversee daily business operations and usually hold a two percent ownership stake. Capital costs and risks are distributed among investors. Therefore, projects that qualify for MLPs can access low-cost capital and provide high rates of return for investors.

The financing mechanism of MLPs has enabled the fossil fuel industry to invest in capital-intensive infrastructure. Expanding MLPs to renewable projects would serve to incentivize investors and expedite wind and solar project development. Further, MLPs have the potential to eliminate the need of federal subsidies for renewable projects.

If enacted, the legislation will provide substantial financing advantages for costly renewable projects, thereby increasing development of clean technologies. The measure would allow the renewable energy sector to mobilize private capital and become more competitive. It also ensures certainty for financiers and provides opportunities for investors.

May 13, 2013 via Energy Solutions Forum

Check out New York Energy Week, organized by Energy Solutions Forum