What are US oil and gas producers most concerned about in the current oil price environment and over the longer term? Financial advisory and consulting firm BDO took a stab at answering that question in their annual BDO Oil and Gas RiskFactor Report, which analyzes the risks listed in the most recent 10-K filings of the… Keep reading →

Upstream

Sign up and get Breaking Energy news in your inbox.

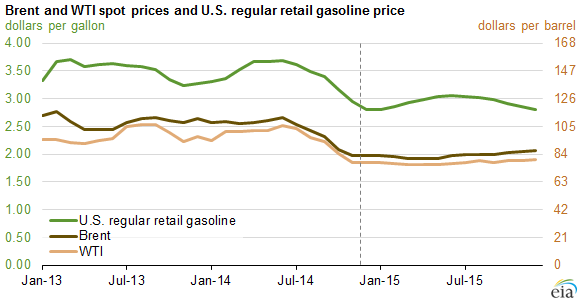

We will never sell or share your information without your consent. See our privacy policy.Energy Quote of the Day: ‘Lowest Price Heading Into a Thanksgiving Holiday Since 2009’

By Jared AndersonThe oil market is filled with winners and losers. When oil prices decline, refiners generally win as their feedstock is less expensive, but producers lose as they get less money for their product. This highlights the attraction of vertical integration – operating both upstream production and downstream refining – which can insulate companies from oil… Keep reading →

Many were praising the wisdom of the vertically integrated oil company business model pioneered by John D. Rockefeller Sr. when ExxonMobil and Chevron today posted higher than expected third quarter earnings that were buoyed by their downstream operations. Oil price decreases weighed on upstream performance, which is typically where these companies generate most of their… Keep reading →

Chevron announced earnings of $5.0 billion for the 3rd quarter, down from $5.3 billion in the corresponding reporting period last year. Upstream operations outperformed the company’s refining and marketing business, which was hit by thinner product margins. “Our third quarter earnings were down from a year ago,” said Chairman and CEO John Watson in a… Keep reading →

ExxonMobil Chairman and CEO Rex Tillerson

ExxonMobil Chairman and CEO Rex Tillerson

ExxonMobil, one of the world’s largest energy companies by operational size and market capitalization, is reaching into its wallet in a big way. Exxon sees significant global energy demand growth – even with the considerable efficiency gains that many expect – and is solidifying its position as a major global supplier of the both the raw commodities and finished products that will fuel global consumption. Keep reading →