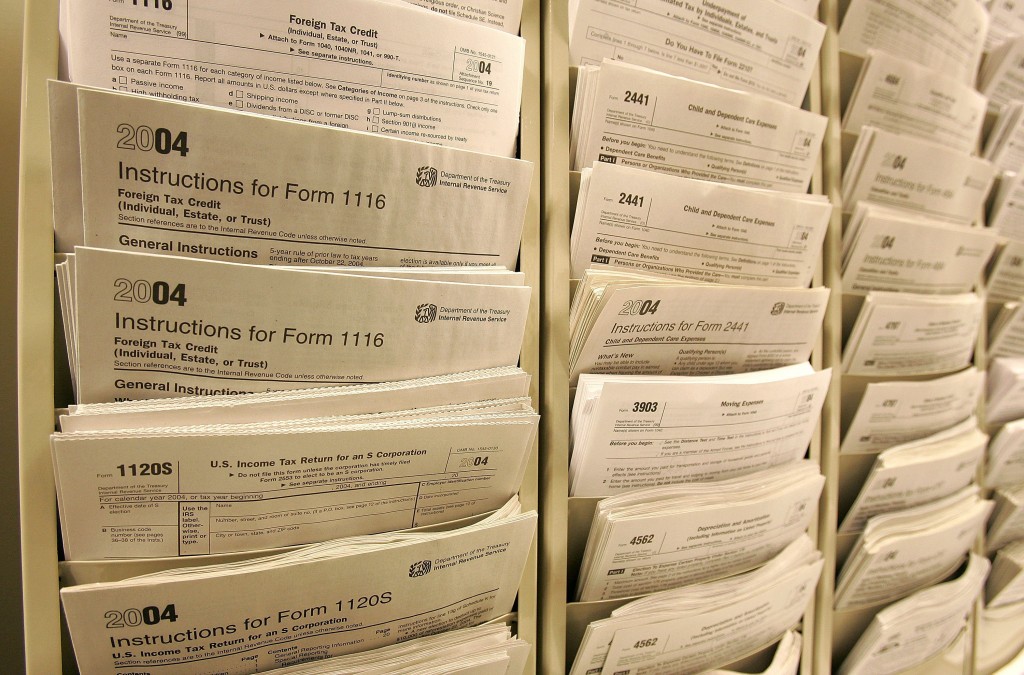

With tax reform on the agenda in Washington this year, the oil & gas industry is paying close attention. One idea is to eliminate a provision that allows companies to write off intangible drilling costs. The industry argues this tax incentive allows them to continually invest in capital-intensive drilling programs and the country’s oil and… Keep reading →

Intangible Drilling Costs

Sign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Taxes account for a significant portion of energy companies’ operating expenses and factor into investment decisions. Some fear that increasing the tax burden on energy companies or removing certain incentives could put the brakes on the recent US oil and gas production boom. Read Breaking Energy coverage of the oil company tax debate taking place… Keep reading →

Obama Touts Solar in SOTU: “We’re Becoming a Global Leader in Solar Too.”

By Roman KilisekPresident Obama proclaimed in his 2014 State of the Union address that his “all the above” energy strategy is working. He then directed the focus to one specific renewable energy source, stating the following: “Now, it’s not just oil and natural gas production that’s booming; we’re becoming a global leader in solar too. Every four… Keep reading →