The largest US nuclear plant owner Exelon said it may shut nuclear facilities to shore up its balance sheet if profits do not improve this year. Historically low natural gas prices and renewable energy sources have decreased the price the utility receives for the power it sells. “Exelon owns 10 nuclear power plants, six of… Keep reading →

Exelon

Energy News Roundup: Utility Searches for Direction in Turbulent US Energy Markets

By Jared AndersonSign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Saudi Arabia has taken another step towards building up its nuclear power generation capacity by signing a Memorandum of Understanding for in-country collaboration with Westinghouse Electricity, Exelon Nuclear Partners and Toshiba. Nuclear could be a key tool in managing a mismatch between rising in-country energy consumption and a heavy dependence on oil exports to meet… Keep reading →

When Exelon merged with Constellation, Joe Glace started reporting directly to the president and CEO, Christopher Crane. As the Chief Risk Officer for the mega-utility, it was imperative that he was part of company’s executive committee.

“The new Exelon will have a significantly increased scope across the energy value chain,” Crane said at the time of the announcement in December 2011. “It is vital to our future success that we diligently manage risk from an independent and enterprise-wide perspective.” Keep reading →

Americans are accustomed to being told that they are running behind other countries, that other places are doing a better job of educating their young or building high-speed railroads or ensuring access to healthcare. Energy efficiency would seem to be the last area in which the US, with its famously well-lit and climate-controlled lifestyle, would be leading.

But in fact, demand response markets that allow customers and power providers to reap the benefits of “negawatts” (essentially un-used power they would traditionally demand or need to supply) are highly developed in the US, if admittedly still imperfectly understood and applied. The market for demand response, which is the activity that creates “negawatts,” has grown from essentially nothing a decade ago to a $3 billion market today, Joule Assets CEO Mike Gordon told Breaking Energy on the sidelines of the AGRION Energy & Sustainability Summit in New York City this month. Keep reading →

Six months ago two Louisiana sheriffs were shot to death and two more injured in the parking lot of a Valero oil refinery. Six years ago Saudi police halted a pair of armed terrorist attacks on the world’s largest refinery, in one case opening fire on a car that exploded near the facility’s gates.

Guns are more than a theoretical issue for the energy business, which controls much of the world’s most vital – and most vulnerable infrastructure. As the US contends with a public debate given new urgency by a series of high-profile shootings, the issue of security and gun control in and around key energy infrastructure is once again front of mind for many of the bodies charged with monitoring energy security and devising responses to potential threats. Keep reading →

While the nation has been focused on new sources of natural gas and shale oil, few noticed the slow decline of an older energy source, nuclear power. Today, commercial nuclear power is struggling to stay in the game.

The power markets are hammering the nation’s nukes. Over a decade ago, several regions decided to create Regional Transmission Organizations (or Independent System Operators) and use the market to set power prices. Today, North America has ten independent RTOs/ISOs, where wholesale power is auctioned every few minutes. Keep reading →

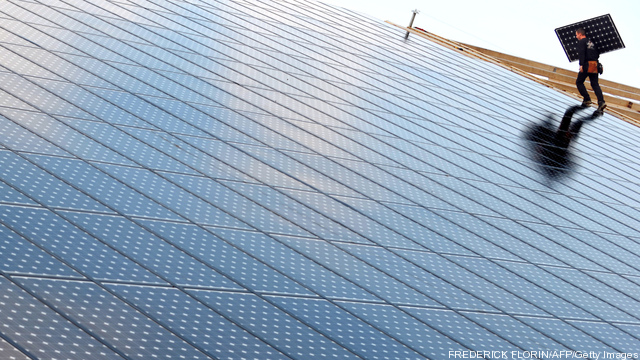

Solar power reduces electricity prices. As more solar is added to deregulated power grids, power prices fall lower. The secret sauce is the markets.

Deregulated power markets are invisible to many Americans, yet every few minutes they set the price for much of their electric power. There are ten separate power markets currently operating in the North America. According to the ISO/RTO Council, they serve approximately two-thirds of electricity consumers in the United States and more than half of all consumers in Canada. Keep reading →

Power prices are too low. That’s what utility executives believe. They need prices to increase for their generators to return healthy earnings. Otherwise, they will have to retire plants and exit the market.

Power prices are too low. That’s what utility executives believe. They need prices to increase for their generators to return healthy earnings. Otherwise, they will have to retire plants and exit the market.

Dominion Resources decided not to wait. They recently announced plans to retire their Wisconsin-based Kewaunee Nuclear Power Station 21 years early. Dominion concluded they would not be able to achieve any earnings for their 556-megawatt unit, they might even lose money and they could not find anyone to buy it. They had no choice but to shutter and decommission Kewaunee. Keep reading →