By now, both producers and midstream companies are aware of the Bankruptcy Court decisions in the Sabine bankruptcy proceedings.

E&P

Sign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.‘Fit For 50’ – Restructurings Likely As Oil Industry Enters New Normal

By Simon Tysoe | Latham & Watkins LLPThe Shale Bankruptcy Boom Moves Midstream

By Joseph V. Schaeffer | Spilman Thomas & Battle, PLLCEnvironmental Groups File Suit Seeking Revision Of E&P Waste Regulations

By Ali Abazari | Jackson WalkerOil Price Turbulence Benefits The Opportunistic

By Simon Tysoe | Latham & Watkins LLPAugust 2015: Energy Litigation Update

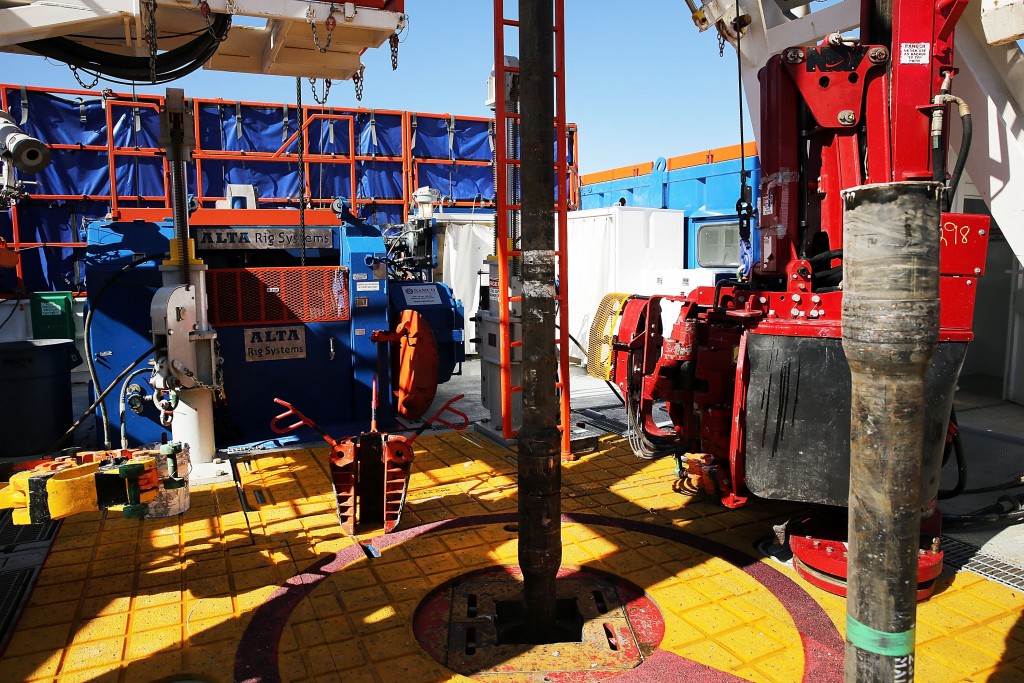

By Quinn Emanuel Urquhart & Sullivan, LLPFeatured Job: Dallas-Based Privately Held E&P Seeks Senior Drilling Engineer

By Kinetic Energy StaffingDallas-based privately held E&P seeks to hire a Senior Drilling Engineer. Qualified candidates will have a bachelor’s degree in engineering and a minimum of 12 years of experience with both service companies and operators (3-4 years maximum on the service side). Candidates with domestic horizontal drilling experience will be shown preference. The Senior Drilling… Keep reading →

The spread between benchmark crude oil prices for WTI and Brent recently widened to over $10 per barrel after reaching parity this past summer, and signals indicate this is partially due to an oversupplied US Gulf Coast refining center. It also suggests that equity investors might want to be wary of US Exploration & Production… Keep reading →

Tax reform may not be the sexiest topic, but it’s an extremely important issue for oil and gas companies with strict investment criteria and some of the highest up-front costs of any industry. The words “subsidies” and “incentives” are often mixed up and thrown around in the energy business to either promote or denounce policies… Keep reading →