Despite its rapid growth, the US solar market is still a bit of a Balkanized mess. It’s a highly fragmented collection of states with different policies and politics, some that have preferential programs such as Renewable Portfolio Standards (RPS) or net energy metering (NEM), and others that are resistant to change or beholden to incumbent… Keep reading →

Investing

Sign up and get Breaking Energy news in your inbox.

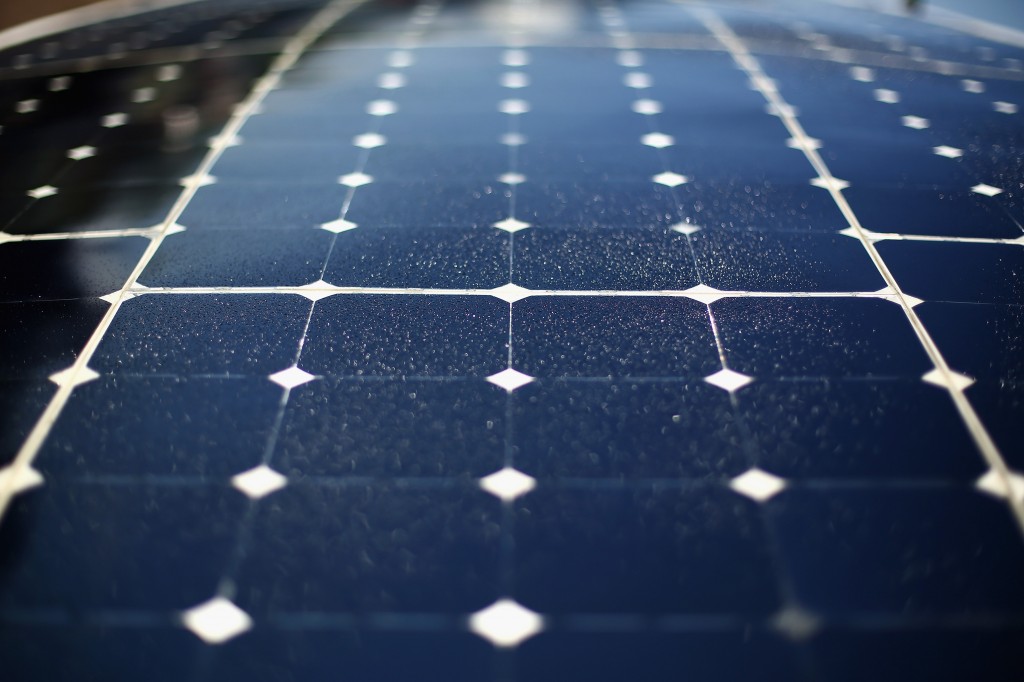

We will never sell or share your information without your consent. See our privacy policy.Google and private equity firm KKR are investing $400 million, including equity and debt financing, in six solar power plants being built by a subsidiary of Japan’s Sharp Corp. The projects have a combined capacity of 106 megawatts and should begin operating by January. [Reuters] The Tennessee Valley Authority is retiring eight units at three… Keep reading →

You may not know this, but the United States is already the largest natural gas producer in the world, according to the U.S. Energy Information Administration, and is estimated to produce more oil than Russia and Saudi Arabia in 2013. The U.S. greatly reduced its dependence on foreign energy imports in a very short time.… Keep reading →

The spread between benchmark crude oil prices for WTI and Brent recently widened to over $10 per barrel after reaching parity this past summer, and signals indicate this is partially due to an oversupplied US Gulf Coast refining center. It also suggests that equity investors might want to be wary of US Exploration & Production… Keep reading →

Uncertainty and Investment in Electric Generation Don’t Mix: the Real Danger to the Coal Industry

By Elias HinckleySupporters of coal have called the planned new rules from the EPA on CO2 emissions from coal-fired power generation a war on coal and have pledged to fight the rule-making process. It is true that there will almost certainly not be a new coal-fired electric generating station built in the U.S. for at least the… Keep reading →

Where do we begin? Breaking Energy featured the Russian energy business in a recent Quote of the Day and it’s not that we’re picking on the country, but the murky world of Kremlin insiders – many former KGB personnel – running oil and gas companies with shares listed on public exchanges is nothing short of… Keep reading →

Ukraine is trying to throw off the Russian natural gas yolk, and finding some success. The former Soviet satellite is importing gas from Germany – though much of it likely originated in Russia – and neighboring countries via reverse-flow pipelines. Importing fewer volumes of Russian gas directly and newfound supply diversity puts Ukraine in a… Keep reading →

If the sky isn’t falling when it comes to energy availability, what does that mean for your portfolio?

After years of forecasts – part of a long tradition – that oil supplies were close to running out with the potential for immense supply shocks for the global economy, Wall Street analysts are beginning to build a new consensus around the potential for an unexpected and still-emerging demand-side shock. Keep reading →

In his 2013 State of the State Address, New York Governor Andrew M. Cuomo proposed a $1 billion “Green Bank” to draw in private sector money and spark investment in clean energy projects. The Governor also named a “Cabinet-Level Energy Czar” to advance his clean tech strategies. The announcements are a step forward to promote renewable energy development and boost New York’s clean energy economy.

Governor Cuomo, at his 2013 State of the State address on January 9, 2013, announced innovative proposals to continue clean energy economy advancement. Central to his strategy is a $1 billion Green Bank, a fund that will draw in private sector money to match public funds and spur investment in clean energy technologies. The goal is to provide low-cost and low-risk financing for renewable projects and energy efficiency programs. Part of the funds from Energy Efficiency Portfolio, Renewable Portfolio Standards, and System Benefit Charge will fund the Bank and attract private investment. Governor Cuomo also named Richard Kauffman, Senior Advisor to Energy Secretary Steven Chu, as “Cabinet-Level Energy Czar.” Kauffman will oversee the Green Bank and head the new sub-cabinet formed to oversee clean energy policy and funding. Keep reading →

Both venture dollars and deal counts were down in the first three quarters of 2012 (note: link opens pdf) and Q4 doesn’t feel poised to surprise on the upside. Even follow-on funding has been down, but mostly it’s the initial investments (Series A, etc) that have fallen by the wayside. This is driven by the significant withdrawal of generalists from the sector, and the reality that specialist VC firms are low on capital reserves. More on this below, but it doesn’t seem like LPs will suddenly start demanding VCs invest in cleantech or start making big commitments to the sector, at least in the next few months, and there’s a lag time between such shifts at the LP level and how deal volumes flow down through the GP level anyway.