Domestic natural gas abundance – safely developed with modern hydraulic fracturing and high-tech horizontal drilling – has benefitted consumers and the economy while reducing greenhouse gas emissions and helping make our air cleaner.

Sustaining and growing those benefits largely depends on market growth for natural gas – to add production that production must have new and/or growing markets to supply. Policy can affect the potential for that market growth. The U.S. Energy Department’s (DOE) continued push to bail out failing coal and nuclear plants is a prime example.

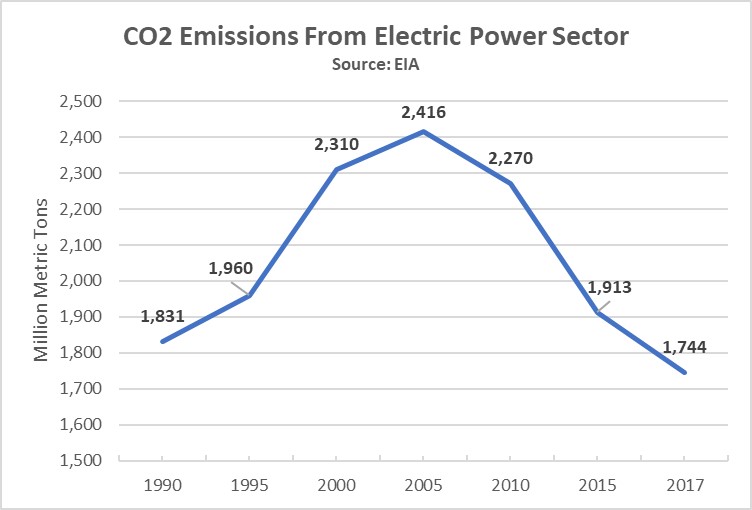

DOE’s initiative clearly would tilt the playing field away from the fuel sources for electricity generation that have been growing and also helping reduce carbon dioxide emissions – natural gas (the leading U.S. fuel), wind and solar. Increased use of natural gas is the main reason CO2 emissions from the power sector are at 25-year lows:

The emissions-reduction milestone is particularly notable with the U.S. Energy Information Administration reporting that total U.S. energy demand increased nearly 18 percent from 2000 to 2016. Meanwhile, global emissions rose 50 percent over the same timeframe, so the U.S. has made environmental progress while adhering to free-market principles – the best of all worlds.

So, in addition to tens of billions of dollars that might be spent to support coal and nuclear, promoting uneconomic plants could squeeze prospective market growth for natural gas while also raising costs to electricity consumers by $16.7 billion or more per year.

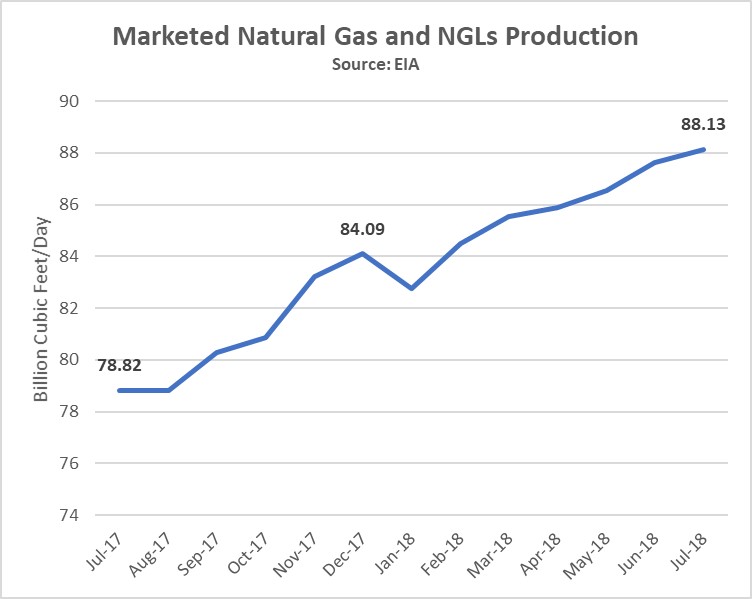

This would be untimely and unfortunate. Over the past year, the U.S. natural gas industry quietly achieved another milestone: unprecedented growth of more than 9 billion cubic feet per day (bcf/d) in July – 12 percent more than July 2017, according to EIA:

This is remarkable because a few years ago, even many in the natural gas industry were skeptical that U.S. shale gas production would continue to rise so strongly.

But American technology and process innovations have enabled tremendous supply growth and lower prices. Natural gas prices at Henry Hub fell to $2.80 per million BTU (mmbtu) in July from $2.96 per mmbtu one year ago.

There’s also a distinct regional flavor as reinvigorated dedicated gas drilling as of May was up in Pennsylvania (13.7 percent over May 2017), in Ohio (18.9 percent), in Texas (21.6 percent), and in Louisiana (25.4 percent).

According BTU Analytics, the breakeven costs to drill a gas well in the Appalachian basin (Marcellus/Utica formations in Pennsylvania, Ohio and West Virginia) or the Haynesville formation (Texas, Louisiana and Arkansas) was below $2 per mmbtu in July 2018 and highlighted continued improvement compared with previous years. Natural gas breakeven costs gas below $2 per mmbtu were impossible just a few years ago, unless a well also produced significant amounts of oil or natural gas liquids (NGLs) that raised its output value.

These breakthroughs are examples of the U.S. natural gas industry powering past the impossible, making important and growing economic contributions, and advancing environmental progress. There’s absolutely no reason why we cannot take two steps forward, and none back, given the demonstrable gains and benefits.

Yet, here’s the challenge: Keeping the U.S. energy renaissance going requires the continued development of markets for U.S. natural gas at home and abroad and overcoming obstacles that appear on the horizon. Sound policy choices can help:

- A level playing field in which fuels can compete in the power generation sector. Policymakers must resist calls for subsidies and/or other market interventions that favor one fuel over another.

- Smart and forward-looking trade policies that foster access to global markets – as opposed to tariffs and other trade barriers that increase industry costs and disadvantage U.S. natural gas in the global market.

- A healthy business climate for large and long-term investments.

With the right policies in place, U.S. natural gas abundance can continue to bring a range of benefits to American consumers, manufacturers and other business sectors while also continuing to lead progress on reducing greenhouse gas emissions.

By Dr. R. Dean Foreman

Originally posted August 23, 2018

Energy Tomorrow is brought to you by the American Petroleum Institute (API), which is the only national trade association that represents all aspects of America’s oil and natural gas industry. Our more than 500 corporate members, from the largest major oil company to the smallest of independents, come from all segments of the industry. They are producers, refiners, suppliers, pipeline operators and marine transporters, as well as service and supply companies that support all segments of the industry.