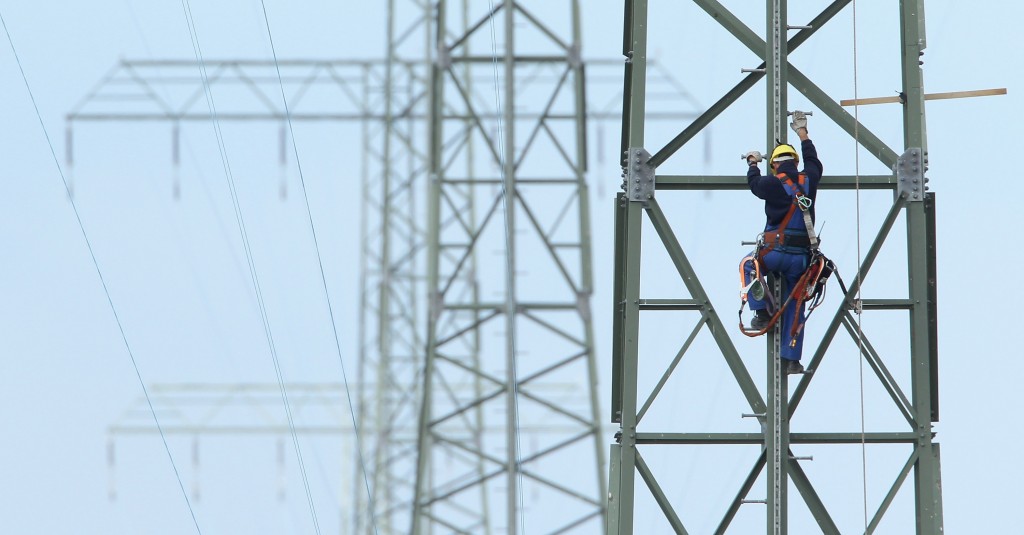

The US power sector is just beginning to understand the extent of the challenge it faces in replacing a retiring workforce, and to take steps to address it. But even if utilities manage to fill vacant positions, it remains to be seen how smoothly they can integrate a new generation of workers, and how long… Keep reading →

PricewaterhouseCoopers

Sign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Persistently low natural gas prices and a search for stable cash flows helped drive a large year-over-year increase in power and utilities mergers and acquisitions in 2Q 2013, according to accounting giant PricewaterhouseCoopers. The value of North American power and utilities M&A deals worth $50 million or more rose sharply year-over-year, reaching $12.5 billion, up… Keep reading →

US President Barack Obama said in a July 27 interview with the New York Times that construction of the Keystone XL pipeline would create around 2,000 jobs during construction – which he estimated would last one to two years – after which that number would fall off to 50-100. Oil and gas trade group API, unsurprisingly,… Keep reading →

Methane leakage – specifically its contribution to greenhouse gas emissions – has made headlines in the news as a potential downside to the US natural gas boom. While much of the attention has been focused on the gas production process, leakage at the regulated natural gas transmission and distribution level also has the potential to raise… Keep reading →

Mergers and acquisitions in the utilities sector picked up in the first quarter as companies have begun to jettison merchant plants, according to PricewaterhouseCoopers US power and utilities deals leader Jeremy Fago. PwC reported that first-quarter deal value in the utilities sector rose by 33% over the same period a year ago. This was driven… Keep reading →

Structuring renewable energy projects that provide acceptable investment returns is often helped by using feed in tariffs in European and other markets, but tax equity vehicles are more common in the US. Tax equity arrangements can be structurally complicated and difficult to administer, but can also provide double-digit returns when done properly.

These were some of the issues discussed by an expert panel at the AGRION Energy Summit and Sustainability Meeting held this week in New York City. The production tax credit for wind projects – recently extended for one year after much controversy – and the investment tax credit for solar are two tax equity vehicles commonly used in the US to help finance projects. Keep reading →

For many decades the benefits of oil and gas development in the US have been overshadowed by the amount of money companies in the sector have made, the environmental impacts of use or development and occasional accidents and the degree to which imports impact US foreign policy and economic health.

The extent to which the US oil and gas business drives job growth, contributes to local and the national economies and has renewed potential to shift economic and political power back to the US were the focus of the American Petroleum Institute’s State of American Energy presentation in Washington, DC today. API has sought ways to boost the reputation of the oil and gas industry in recent years after the industry faced unprecedented opposition to new development both on-and-offshore as new technology allowed access to onshore reserves and offshore development revived. Keep reading →