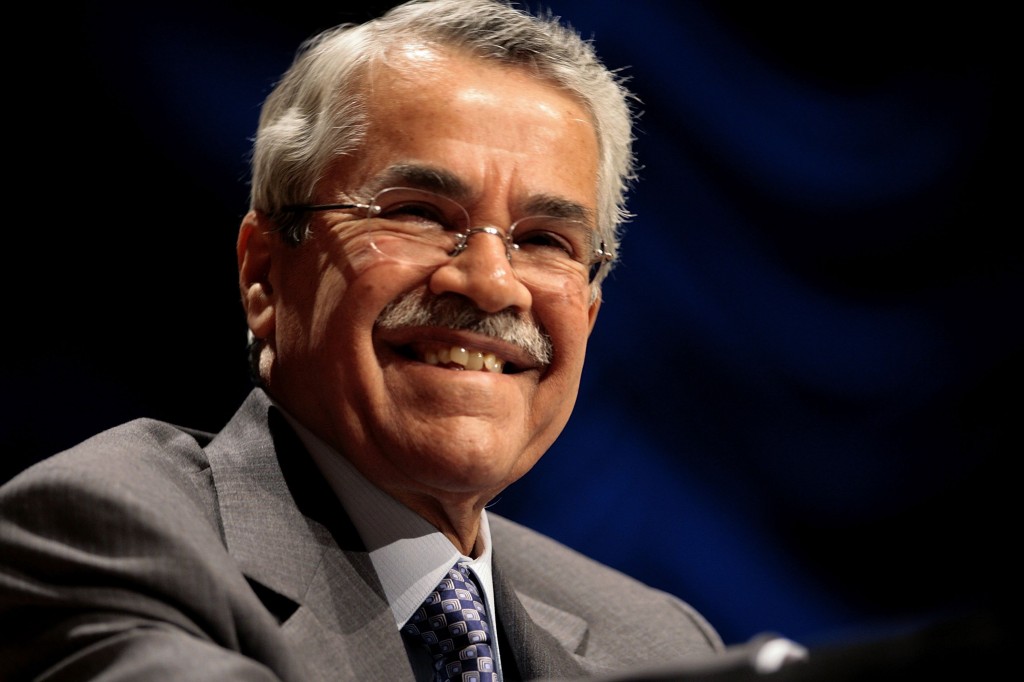

Saudi Arabia’s oil minister, Ali al-Naimi, recently said again that OPEC will not take sole responsibility for supporting global oil prices. Since the collapse in oil prices this past year, OPEC has attempted to convince non-OPEC oil producers to cooperate on production and prices, but with little success. “Today the situation is hard. We tried, we… Keep reading →

Non-Opec

Sign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.With all eyes on the global crude oil market due to recent price declines, analysts and investors are frantically searching for the bottom, with some expecting a continued plunge. While there could still be some short-term volatility and downward pressure, Barclays’ analysts see oil prices strengthening by mid to late 2015. Crude oil futures prices… Keep reading →

Alarmist media reports regarding oil’s foray into bear market territory could easily leave you thinking the oil industry is gasping its last breath. It certainly is not, as companies involved in the global oil complex are accustomed to commodity price volatility and most have experienced similar, if not worse, market corrections. In fact, over the… Keep reading →

Energy Quote of the Day: ‘The Fog of War Will not Clear for a Long Time;’ Oil Price Impact?

By Jared AndersonGeopolitical turmoil and security threats in major producing regions are never good for oil market stability, and while global benchmark oil prices have been cruising through an historic range-bound lack of volatility for an extended period, geopolitical headwinds show no sign of abating in the near term according to Barclays’ research. The bank forecasts 2014 Brent… Keep reading →

Energy Security: ‘Euphoria over Abundance’ is Misplaced says Jason Bordoff at IAEE Conference

By Roman KilisekThe highly informative and thought-provoking 2014 annual International Association for Energy Economics (IAEE) International Conference came to a successful close last week in New York. The energy world, a world of disparate natural resources endowments that constantly wrangles with its steady companion ‘political risk’, is highly volatile and, therefore, always in flux. In this context, Jason… Keep reading →

ExxonMobil’s Ken Cohen highlights the tax payments made by some of the largest US-based oil companies, three of which – Exxon, Chevron and ConocoPhillips – appear in a list of the Top 10 corporate tax payers in 2012 compiled by 24/7 Wall Street. “In fact, ExxonMobil and Chevron are ranked #1 and #3 respectively, with… Keep reading →

The oil producers’ cartel will discuss cutting back output at its meeting this Wednesday in Vienna. Iraq’s output continues increasing, Iran could export more barrels as a result of last week’s nuclear deal and non-Opec production has been strong with US output soaring – all bullish supply factors that could put downward pressure on prices… Keep reading →

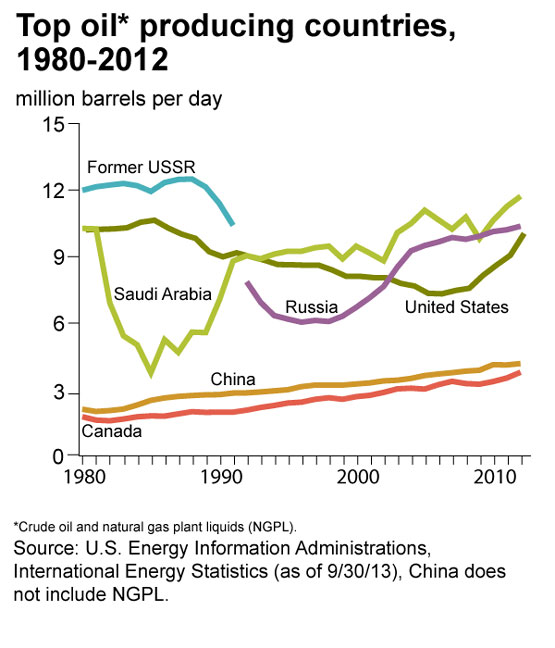

The Saudis are pumping oil near 32-year highs – north of 10 million barrels per day – and much short-term non-Opec supply growth is expected from Brazil where technically-challenging, deepwater, subsalt projects could experience delays, investment bank Simmons & Co. said in a recent note analyzing Oct’13 IEA Oil Market Report data. “For the time… Keep reading →

Investment bank Simmons & Co’s commentary on the International Energy Agency’s August Oil Market Report highlights geopolitical risk facing global oil supply. The report shows that Opec supply fell by 165,000 barrels per day from the previous month, even as Saudi Arabia lifted output to a 12-month high. “Domestic developments in member countries has taken… Keep reading →

By Jenny Cosgrave, Staff Writer The rise of North American oil supplies could test the future of OPEC which may have to curb supply to accommodate rising shale oil volumes, a new report has found. The increase in U.S. output is a “defining feature of tomorrow’s market” according to International Energy Agency’s oil market report… Keep reading →