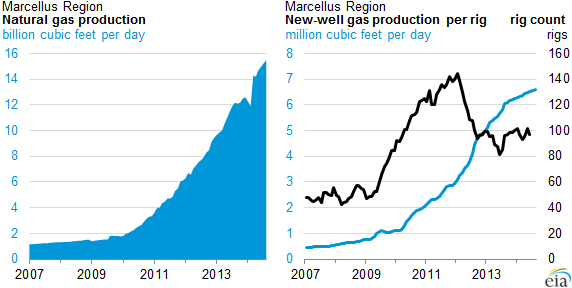

Marcellus shale gas producer Range Resources reported record production of 1.2 billion cubic feet per day equivalent of natural gas, but getting that gas to higher-value markets is proving a bigger challenge than producing it. “Executives quoted forecasts showing that between mid-2015 and 2018, pipeline companies are expected to add 34 Bcf/d of midstream capacity.… Keep reading →

Midstream

Energy News Roundup: Record Gas Output for Range, Scottish Wind Faces Subsidy Shortfall & Vattenfall Dances Around Coal

By Jared AndersonSign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Energy News Roundup: Ethanol Decreased US Gasoline Energy Content, $50B Midstream Merger & Neutral Zone Oilfield Shut

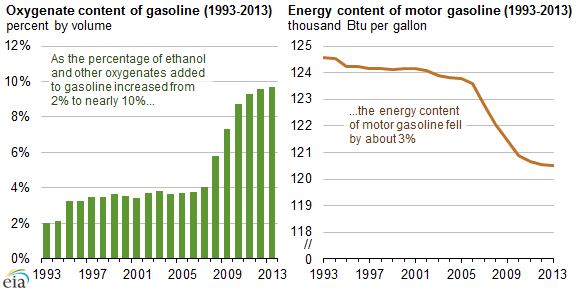

By Jared AndersonAs the volume of ethanol blended into the US gasoline supply increased from 3% to 10% over the past two decades, the fuel’s energy density decreased by 3%, according to the EIA. In an interesting example of how energy/environmental issues are often characterized by tradeoffs, greater volumes of ethanol added to gasoline decreases air pollution… Keep reading →

The 2014 Sustainable Energy in America Factbook was produced for The Business Council for Sustainable Energy by Bloomberg New Energy Finance and “found that renewable energy, natural gas and energy efficiency advancements are leading a transformation of America’s energy,” according to a BNEF statement. This infographic highlights findings from the research that include the increasing… Keep reading →

US independents Anadarko and Noble Energy have agreed to exchange around 50,000 net acres of leasehold in the Wattenberg field in northeastern Colorado. US independent Devon and midstream company Crosstex have agreed to combine Crosstex’s assets and Devon’s midstream assets to form a new midstream business, which remains unnamed for the time being. Devon is… Keep reading →

When people think about applications for natural gas in the US some of the most iconic images are kitchen stove burner tips and large power plants. However, natural gas liquids are widely used in manufacturing thousands of everyday products, as well as fertilizers and other applications that people may not be as familiar with. Keep reading →

From the Steel Mills of Pennsylvania to K Street as Energy Drives Manufacturing Resurgence

By Jared Anderson

Summers in a Pennsylvania steel mill might seem like an unlikely place to find the future president of the American Fuel & Petrochemical Manufacturers association, but that’s where Charlie Drevna got his start. Now, it seems prescient as energy and manufacturing become ever more closely linked in the US.

When Drevna was working the mills, they were manufacturing drill pipe for oil and gas production in Oklahoma and other parts of the country where conventional hydrocarbon resources were being produced in volumes that many expected were in terminal decline. Keep reading →

The idea of powering energy intensive facilities with inexpensive methane from on-site rigs is gaining traction in the Marcellus Shale region. And one of the reasons for the interest is the intensifying focus by exploration and production companies on natural gas liquids.

NGLs, which include propane, hexane, butane, and pentanes, are produced by fractionation after well-gas is processed to separate them from methane and ethane (which can only be liquefied through cryogenic treatment). Keep reading →

Few industries are hit as hard by high oil prices than the airlines, which can spend close to 40% of their budget on fuel. With jet fuel prices near record highs, the drive to conserve is stronger than ever. Delta recently made headlines with its novel bid to buy an oil refinery, taking a more direct role in procuring fuel. But Delta and other airlines are experimenting with a number of other ways to cut costs. The entire industry is hoping a switch from radar to GPS-based navigation will cut the time it takes both to reach cruising altitude and land a plane.

Eni SpA, Italy’s biggest energy company by market value, said Tuesday that a refining boom in the Middle East is putting pressure on European refiners because the MidEast producers, who have lower costs, are now entering the market in Europe especially the Mediterranean. “Italy was a hub for Middle Eastern crude, but not anymore as Middle East [oil companies] are now vertically integrated,” Domenico Elefante, Eni’s executive vice president for refining, told Dow Jones Newswires on the sidelines of the Global Refining Summit in Barcelona. Elefante also said it isn’t a problem for Eni to replace Iranian barrels which are subject to western sanctions as the import volumes have been low. He didn’t provide further details on the volumes.