Citigroup Inc. recently pledged $100 billion for lending, investing, and facilitating deals related to sustainability, renewable energy, and climate change mitigation. This is yet another sign that global capital markets are enormously interested in delivering capital into clean, renewable sources of energy. But you don’t have to be Citigroup to invest in the clean energy… Keep reading →

Citigroup

4 Ways To Invest In The Low-Carbon Economy

By Environmental Defense Fund Energy Exchange BlogSign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Energy News Roundup: Citigroup Predicts Oil Price Spiral, Climate Change Panel & SC Solar Expansion

By Conor O'SullivanCitigroup predicted the recent increase in oil prices is a temporary lull in the downward price trajectory. The bank lowered its crude oil price forecast. “Despite global declines in spending that have driven up oil prices in recent weeks, oil production in the U.S. is still rising, wrote Edward Morse, Citigroup’s global head of commodity… Keep reading →

In 1956, a little-known geologist named Marion King Hubbert published a paper predicting that oil supplies were destined to reach a peak as the cheap and easy to tap reservoirs were depleted over time. He predicted that US oil production would peak somewhere between the late 1960s to early 1970s. Others, including oil financier Mathew… Keep reading →

Ron Wyden, Democratic Senator from Oregon and Chairman of the Senate Committee on Energy and Natural Resources, grilled oil market experts today on why US consumers are not benefiting from higher US oil production via lower gasoline prices at the pump. Those experts indicated that whether or not they are aware of it, US consumers… Keep reading →

By Javier E David Despite the slow rate of adoption of natural gas to fuel motor vehicles, a confluence of trends in favor of natgas is shaping up to loosen the stranglehold petroleum has on the transportation fuel market, according to Citigroup. In a lengthy research report this week, the bank cited rising global natgas… Keep reading →

Investors are abandoning the solar manufacturing sector, but the solar game is far from over, according to one analyst. “There will be a resurgence” of solar after a manufacturing shakeout, Jason Channell, director of investment research and analysis at Citigroup, told CNBC. But “we think the next boom is coming from the storage area,” he… Keep reading →

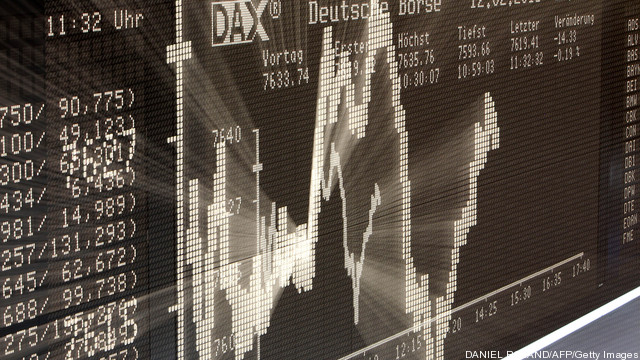

Volatility in the overall financial markets have taken a heavy toll on clean tech companies with IPO ambitions, while valuations of publicly traded stocks had dropped dramatically by two thirds, investment bankers in the sector conceded this week.

Clean tech market sector capitalization was valued at $475 billion at the high point in 2007, said David Dolezal, head of the Americas Renewable Energy and Cleantech division at UBS, the largest trader of clean tech stocks. But that figure has now been slashed to $142 billion, the equivalent market capitalization of pharmaceutical giant Pfizer. Keep reading →

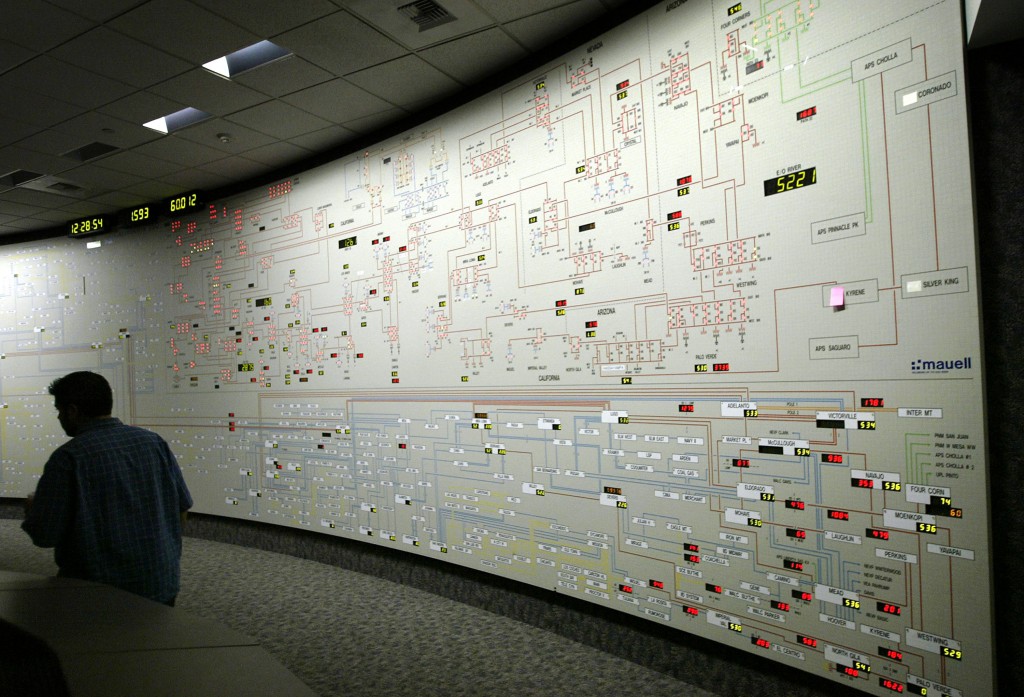

Low natural gas prices are likely to persist in the US, which could prompt a new wave of oil and gas asset deals, and potentially industry consolidation.

Robust drilling activity, ongoing productivity gains, a backlog of wells awaiting completion, continued joint venture capital infusions, and hedging activities are all helping to sustain an oversupply of natural gas in the US, said R. Dean Foreman, chief economist, planning and commercial for independent Talisman Energy at the IHS Herold Pacesetters Energy Conference. Read more on the conference: Drilling Advances Trigger Tight Oil Renaissance. Keep reading →