With a projected 2015 loss, the demand response leader seeks growth in enterprise and utility software. Over the next few years, EnerNOC wants to bring in as much money serving up enterprise efficiency and energy management software as it does in its traditional field of demand response. But that transition won’t come without some significant… Keep reading →

Siemens

Sign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.New Technology Critical to Future of Offshore Wind Power

By Roman KilisekGermany’s Siemens has handed over the first of a total of five commissioned North Sea grid connections, the BorWin2 offshore platform, to its customer TenneT, a German-Dutch transmission grid operator, for immediate commercial operation, the company announced in a press release on January 30. TenneT is one of the four Transmission System Operators (TSOs) that… Keep reading →

Energy News Roundup: Energy Storage Gets Competitive, Opec Head Scratching and Siemens Earnings Hit in Russia

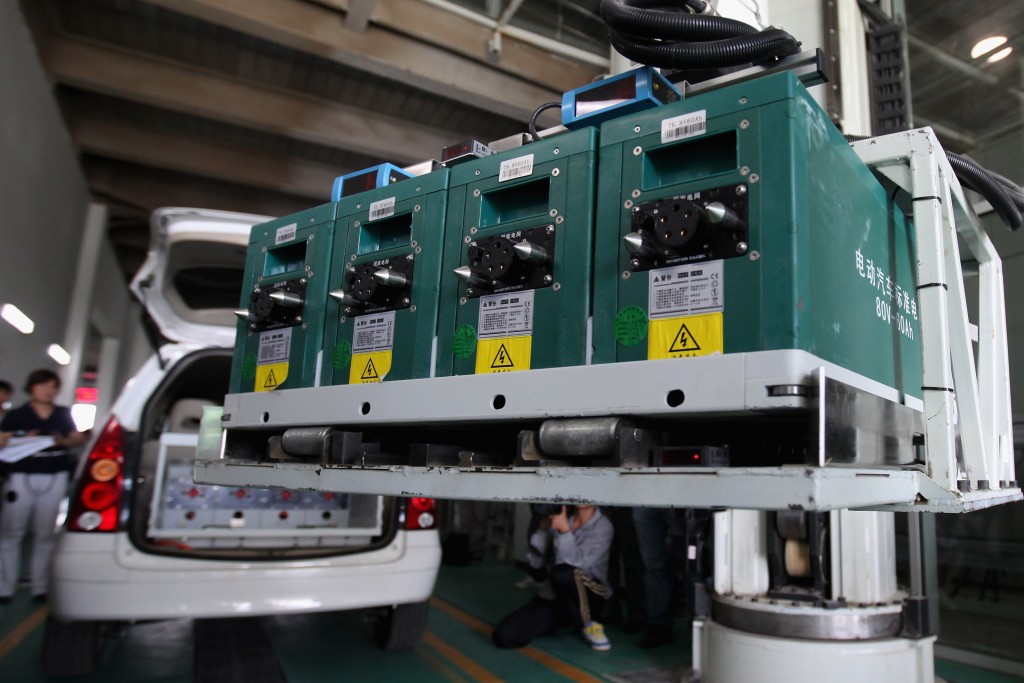

By Jared AndersonFlow battery technology could soon outcompete single-cycle gas-fired turbines according to a new study. “By 2018 the cost of ViZn Energy’s 4-hour storage solution, which was selected by Energy Strategies Group as a proxy for the lowest cost multi-hour storage solutions currently being commercialized, is projected to be $974 per kW, nearly identical to that of… Keep reading →

Still wondering why more nukes are not getting built in the West? In 2002, the Finland’s parliament approved the construction of Olkiluoto 3 expecting completion by 2009. To guard against cost over-runs, Finnish utility Teollisuuden Voima (TVO) signed a €3.2 billion (roughly US$4.2 billion at current exchange rate) fixed-price turnkey contract with a consortium including… Keep reading →

Emissions Reduction: Siemens to Test eHighway Concept for Heavy-Duty Trucks in California

By Roman KilisekGermany’s Siemens, a global powerhouse in electronics and electrical engineering, appears to have received approval from California’s Air Resources Board (CARB), one of five units within the state Environmental Protection Agency (EPA), to built a test track and implement its eHighway concept for heavy-duty trucks, as was first reported by Germany’s Spiegel-Online. Emission standards for… Keep reading →

GE’s apparently successful takeover of key segments of Alstom’s prized energy business raised eyebrows when many thought German energy giant Siemens would prevail. Siemens’ unwillingness to part with its train signaling business – a critical concession made by GE – is reportedly one aspect of the deal that tipped negotiations in GE’s favor. Interestingly, the… Keep reading →

Berkshire Hathaway energy unit MidAmerican Power Holdings has agreed to buy wind turbines with an estimated value of more than $1bln from Siemens. IFM Investors has agreed to invest $1.3 billion in equity funding for the proposed three-train Freeport LNG natural gas liquefaction and export plant in Texas, sourced from a consortium of project finance ledners. The funding in question… Keep reading →

MidAmerican Energy Holdings, a unit of Warren Buffett’s Berkshire Hathaway, has agreed to buy nearly 450 2.3-megawatt wind turbines – with an estimated collective value of over $1 billion – from Siemens. “MidAmerican is expanding in wind as costs fall.” [Bloomberg] China’s move to tackle air pollution could push major Australian coal mining operations from… Keep reading →

Siemens’ financing arm is seeing a shift in project finance from a focus on renewables to a more even mix of renewable and fossil fuel generation, according to US chief executive Kirk Edelman. “What we’re seeing now is a little bit of a shift away from a lot of focus on renewables to a more… Keep reading →

The ongoing boom in energy and industry infrastructure around the world, and the high price tags of many of these projects, have created a niche for entities like Siemens Financial Services, which can serve as a specialized financial intermediary for getting projects funded and built. Siemens Financial Services is the finance arm of technology and… Keep reading →