By Erin Carson, Energy Solutions Forum Several New York Energy Week panels slated for June 25 will highlight the impact of the shale oil and gas revolution on economic growth and national energy security policy. Top officials from industry and government will hold multiple panels in New York to offer new insight into how the oil and gas boom could… Keep reading →

Shale

New York Energy Week will Probe the Trajectory of the U.S. Shale Boom

By Energy Solutions ForumSign up and get Breaking Energy news in your inbox.

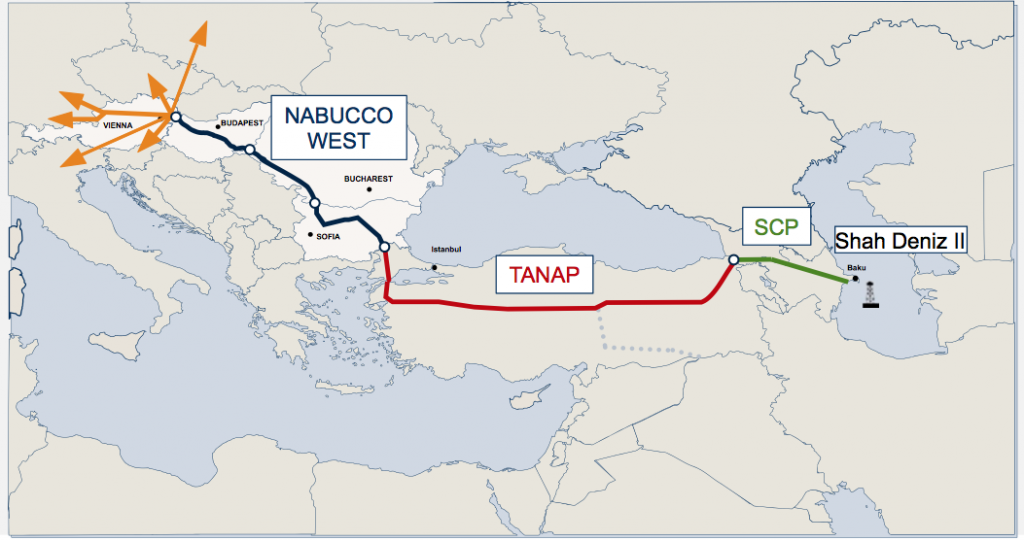

We will never sell or share your information without your consent. See our privacy policy.A pair of proposed pipeline projects may bring more than 90 billion cubic meters per year of natural gas to European markets, but this will not undermine the rationale for developing the continent’s indigenous shale resources, which could offer a range of other economic and security benefits, says Eurasia Group global gas analyst Leslie Palti-Guzman.… Keep reading →

Statoil will assume its first shale operatorship outside the United States through a deal to up its stake in PetroFrontier’s Australian permits to as much as 80%. The Norwegian company will have to spend $160 million on exploration through 2016 under the deal. [Reuters] Opec left its 2013 global oil demand forecast unchanged in its… Keep reading →

By Kiran Moodley Following UK firm IGas’ news that a larger amount of shale gas than previously thought may be available in the north of England, the British Geological Survey (BGS) has urged caution. IGas said there could could be between 15 and 170 trillion cubic feet (tcf) of gas in an area of 300… Keep reading →

Oil companies love to say that their ownership is the average American retiree, and utilities can often claim the same. Look at your retirement account or, should you be so lucky as to have one, your company’s pension plan. Odds are that it is heavily invested in the US energy sector. Shifts in the parameters… Keep reading →

Any game-changing technological advance benefits some industries and challenges others. Ratings agency Standard & Poor’s has compiled a list of winners and losers from the US shale boom in a report, Game Changer: Industry Winners And Losers From The U.S. Shale Revolution, released yesterday. Among beneficiaries of the shale boom are the petrochemical industry, which is enjoying lower… Keep reading →

The refineries along the US East Coast sit close to some of the globe’s largest energy demand centers, but face such high prices for the crude they process that many have struggled to make money. Many import crude oil from Africa and the Middle East, and have been cut off from cheaper supply recently surging out of the middle and west of North America by limits on transportation infrastructure.

Companies like Enbridge, which presented recently at the US Association for Energy Economics, are seeking solutions to a bottleneck that is preventing lower-priced crude from competing on global or even national markets. Much oil currently travels by rail, as we’ve noted on Breaking Energy before, and may increasingly go multi-modal, from pipelines into rail cars and vice versa as it wends its way to energy-hungry Eastern US and Eastern Canadian markets. Keep reading →

Halliburton revealed a 23% rise in first-quarter earnings and topped Wall Street expectations, as demand for oil-rich shale formations kicked higher in the US, lifting its rig count in the region. The Houston-based oilfield services company reported net income of $627 million, or 68 cents a share, compared with a year earlier $511 million, or 56 cents. Excluding one-time items, the company earned 89 cents, ahead of average analyst estimates of 85 cents in a Thomson Reuters poll. Revenue for the three months ended March 31 was up 30% to $6.8 billion, up from $5.3 billion a year ago, matching the Street’s view. However, the company’s operating margin fell to 14.9% from 15.4%.

For Rex Tillerson fracking is more than a revolutionary approach to drilling oil and gas — it’s part of his personal history. Simply mention the word to the CEO of Exxon Mobil and he starts reminiscing about his days as a young engineer. It was 1976, and Tillerson had been sent to East Texas for his second assignment at the company. His job was to follow around rigs drilling for natural gas and “complete” the wells. That meant experimenting with a process known as hydraulic fracturing, or fracking. By pumping water, sand, and chemicals down into a well at high pressure, he could cause cracks in the stone where the gas was trapped and allow more of it to flow.