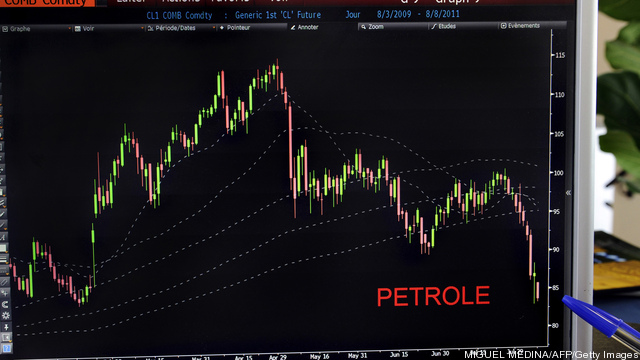

Here’s a mishmash of unrelated energy tidbits. Could oil head down to $70 per barrel? “Growing demand will not as easily erode spare capacity as in recent years,” says R-Squared. [EnergyTrendsInsider] The EU may have miscalculated in deciding to impose tariffs on imports of solar cells and panels from China. [Forbes] And because it’s Friday,… Keep reading →

China

Sign up and get Breaking Energy news in your inbox.

We will never sell or share your information without your consent. See our privacy policy.Why are costs so much lower for Chinese centralized inverters? Module producers aren’t the only ones feeling intense pressure in the solar market. Inverter companies are also facing a looming shakeout as they deal with continued shifts in global demand and strong downward pricing trends. According to a forecast from GTM Research, inverter prices will fall 10… Keep reading →

The New York Times is reporting that China’s People’s Liberation Army has resumed its attacks against Western targets after a three-month hiatus. Shanghai-based Unit 61398 is back in business, says the Times, albeit using different techniques. Past attacks have sought intellectual property and government documents, including blueprints, manufacturing plans, pricing documents, and other proprietary information, mostly from… Keep reading →

Global oil supply dynamics have been shifting in recent years, as consumption levels off in developed western economies and demand surges in rapidly developing Asian nations. At the same time, North American unconventional resource development has accelerated this supply transition to the “east of Suez” market, making the US less dependent on Middle East imports and thus softening the need to police the oil shipping lanes extending from the Persian Gulf. So what is China’s role in this shifting global oil supply/demand picture?

David Schenker, the Aufzien fellow and director of the Program on Arab Politics at The Washington Institute – a think tank – recently traveled to China and found some interesting answers to this question that he summarizes in a piece appearing in today’s Los Angeles Times. Keep reading →

The excitement over solar power, which once attracted billions in private investment and public subsidies, has waned recently, underscoring the limitations of renewable energies and the unchallenged dominance of fossil fuels.

Some of the $75 billion sector’s high profile names have fallen on hard times recently – most notably Suntech Power. The China-based solar panel company rattled the industry when it filed for bankruptcy last week. In its heyday, the stock traded just shy of $90 and had a market capitalization of $16 billion: on Thursday, the last day U.S. markets were open, the shares traded around for 42 cents each. Keep reading →

htt

For most people springtime means flowers, cleaning and putting away winter coats. For people in the energy business, warming weather means they can stop managing for the heating season and brace for the really big stage in the US power sector: cooling season.

With natural gas prices failing to settle lower despite the beginning of what are called the shoulder months in the energy business, when demand for temperature control and other power-sucking activity slips, many are entering the spring months with a renewed sense of uncertainty about their commitment to the fuel. Even a bearish storage report couldn’t weigh down natural gas prices earlier this week, and although prices are nowhere near historical highs the sector has become so accustomed to cheap gas every penny higher makes for a pause given the US large scale “dash to gas” in recent years. Keep reading →

The world’s swelling population and continued economic growth will require increasing volumes of oil to power the cars, trucks, trains and planes that transport people and goods around the planet. But the Citi commodities research team has questioned the extent of that assumption in a new research report titled “Global Oil Demand Growth – the End is Nigh.”

This rethinking of global oil demand trajectory is driven by the analyst’s view that natural gas will increasingly be substituted for oil in the transportation, power generation and industrial sectors, while considerable gains in fuel economy “raise the possibility that the tipping point for oil demand may come much sooner than the markets are expecting.” Keep reading →

Trade in derivatives has been one of the most controversial activities in finance since the opacity around those markets was held by observers to blame for the scale and depth of the financial crisis of 2008. One of the key solutions recommended by regulators was to move trade in contracts onto exchanges, where they could be monitored more closely.

That effort showed early signs of success as the more-liquid contracts moved online but efforts to make exchange trading the default have faltered and – for many types of derivatives – actually reversed. Keep reading →

The United States is reportedly under attack by the Chinese government. America’s business secrets, critical infrastructure and wealth are the targets. But many businesses are taking a lackadaisical approach to cybersecurity. Multiple industry studies have shown that the vast majority of companies don’t begin following cybersecurity best practices until after they’ve been hit. The latest and most telling example came Tuesday. According to a new report from information security company Mandiant, the Chinese military is linked to one of the most prolific hacking groups in the world. That group, known as the “Comment Crew,” has attacked Coca-Cola (KO, Fortune 500), EMC (EMC, Fortune 500) security division RSA, military contractor Lockheed Martin (LMT, Fortune 500), and hundreds of others. It reportedly holds the blueprints to America’s energy systems, and has funneled trade secrets out of some of the country’s largest corporations. The implications of China’s presence in Corporate America’s networks are vast, from matters of economic competitiveness to international diplomacy.