The oil market is filled with winners and losers. When oil prices decline, refiners generally win as their feedstock is less expensive, but producers lose as they get less money for their product. This highlights the attraction of vertical integration – operating both upstream production and downstream refining – which can insulate companies from oil and refined product price volatility.

US gasoline prices have followed global benchmark oil prices downward. Oil prices have fallen 30% from summer highs above $110 per barrel. While oil producers scramble to digest this major price decline – Opec is weighing a production cut decision that will be announced tomorrow – fuel-intensive US industries are winning along with consumers who are paying less to fill their tanks this Thanksgiving.

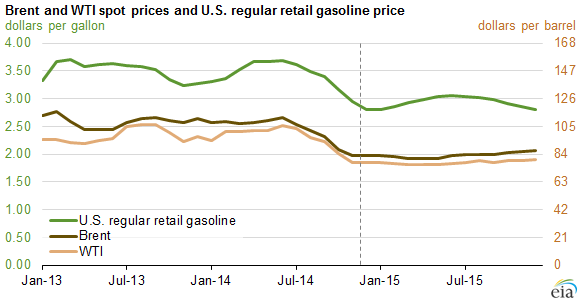

“U.S. retail regular-grade gasoline prices continue to decline, averaging $2.82 per gallon (gal) as of November 24. This average is 47 cents lower than a year ago, and the lowest price heading into a Thanksgiving holiday since 2009… Much of the decline in gasoline prices since mid-2014 is attributable to falling crude oil prices. The combination of robust U.S. crude oil production growth, a return of Libyan production (despite recent setbacks), weakening expectations for the global economy (particularly in China), and seasonally low refinery demand has reduced oil prices. North Sea Brent spot prices have fallen from a July monthly average of $112 per barrel (bbl) to a November monthly average of $80/bbl (through November 24). The average U.S. retail regular-grade gasoline price has fallen 88 cents/gal since the start of July.” – EIA

So Happy Thanksgiving! Unless you are an Opec member or an E&P company.