First, BP dropped plans to invest in a refinery in Qinzhou. Then PetroChina delayed plans for it’s Kunming refinery, part of a larger plan that includes a pipeline linking Southwestern China to the Bay of Benegal through Myanmar (bypassing the Malacca Straits). Now, two of the largest Chinese national oil companies (NOCs) are paring back on spending plans for 2014. It’s all part of slowing demand growth and what Chinese oil companies call a focus on quality over quantity. But one NOC – the offshore specialist CNOOC – is increasing capital expenditure (capex) spending. Who is reading the tea leaves wrong?

Half-Empty

Despite news that China’s imports of petroleum and other liquids began to outpace those of the US in September of last year (the US still consumers more oil than China, but domestic production is also higher), demand is flat lining in the country. Diesel demand – the largest single component of China’s overall oil demand – was down in the first two months of the year and refiners cut run rates in January by 10% from a year earlier. In 2013, China’s largest refiner Sinopec kept diesel production flat from the year before at 77.4 million tons, while gasoline production increased 12.36% to 45.56 million tons. Signs of slowing are apparent throughout the country – not just in oil consumption – and refiners have taken the clue. For this cycle of expansion and retraction, capex has peaked for China’s two largest oil companies.

The pared back spending plans of Sinopec and PetroChina “reflects a step back from the ‘irrational exuberance” of previous CEOs, partly as a result of policy from new government,” Philip Andrews-Speed, Principal Fellow at the Energy Studies Institute (ESI) of the National University of Singapore told Breaking Energy.

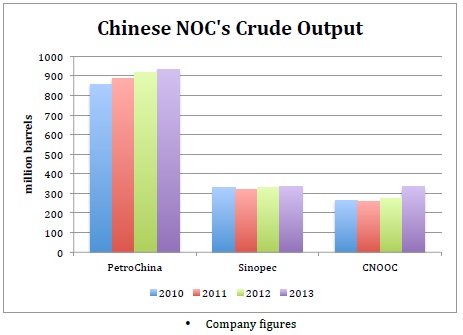

Over the past few years, capex rose steadily at NOCs, increasing refining capacity to the point where the country is poised to be a net exporter of diesel fuel – something its traditionally imported – with potentially large ramifications on the Asian markets. Higher budgets for exploration and production (E&P) led to marginally higher rates of crude output, while natural gas production increased in the double digits (see chart). But the leadership in Beijing expects oil production to remain essentially flat around 4 million barrels per day. Production will rise over the next two years, say analysts, but production costs will continue to increase, putting pressure on margins.

Refining margins have swung drastically over the past few years and Chinese refiners are cutting back expansion plans, despite Beijing rolling out higher fuel standards. The government’s more responsive pricing policy helped margins last year and analysts expect these to stay positive this year. The ongoing adoption of China IV gasoline and diesel (similar to Euro IV standards), along with higher prices, should also help recoup costs. But it means upgrading some facilities and adding capital costs. That is, if its implemented properly, says Andrews-Speed.

2014 Spending Plans

Global spending on exploration and production (E&P) will increase by 6.1% to $723 billion this year, according to investment bank Barclays. E&P will stay steady at both PetroChina and Sinopec, while the companies trim spending in other areas. (see chart). CNOOC will increase E&P spending. Neil Beveridge, senior analyst Bernstein Research wrote: “Encouragingly, China’s oil majors (with the notable exception of CNOOC) have embraced ‘quality over quantity’ with capex cuts announced for 2014 as their focus shifts away from scale and more towards returns.”

Sinopec’s capex will decrease this year by over 12% to 161.6 billion yuan ($26 billion), despite the push towards developing shale gas fields in southwestern China and plans to increase oil and gas output. The company expects oil and gas production to increase 8.6% to 481 million barrels of oil equivalent (mm boe) after it only rose 3.48% in 2013 to 442.84 mm boe. Most of that was growth came from natural gas, as crude oil production stayed almost flat last year at 332.54 million barrels. Natural gas production increased by 10.4% to 660.18 billion cubic feet (bcf).

PetroChina’s capex will fall again in 2014, after a slight drop last year. The drop is mainly due to lower spending on natural gas and pipeline construction; planned expenditures will drop 35% this year after falling 21% the year before. The company consistently loses money on natural gas imports, which reached 41.9 billion yuan last year ($6.75 billion).

CNOOC’s 2014 capex could double levels spent in 2012, despite the slowing growth. Expected capex this year will be between 105-120 billion yuan ($16.9-19.3 billion) and 16-32% higher than last year. Spending on exploration and production will increase by 5.5-10.5 billion yuan over last year, with an expected 10-23 mm boe per day of production (these numbers include spending and production for Nexen). “While the focus for large cap oil companies is cost reduction and capex cuts, CNOOC management simply do not get the new realities of the commodity cycle we are in. While production remains the be-all and end-all of management attention, they are failing to meet targets. At the same time, costs are simply out of control,” according to Beveridge.

With leveling demand, pressures from Beijing and an increasingly hostile environment for oil companies (see article on protests), cutting back on capex seems to be the pertinent move.