In what could already be described as stunning news – and would become a stunning development if it materialized – is a report by Reuters that the United Arab Emirates (UAE), an OPEC oil producer situated in the Persian Gulf, is “said to be looking at the possibility of importing natural gas from North America.” Reuters characterizes it as “one of the most striking developments since the start of the U.S. shale boom” while quoting UAE’s Oil Minister Suhail bin Mohammed al-Mazroui at an energy conference at Chatham House in London as saying: “We may follow the same trend of considering investments in the United States and Canada to bring some of that gas back home.”

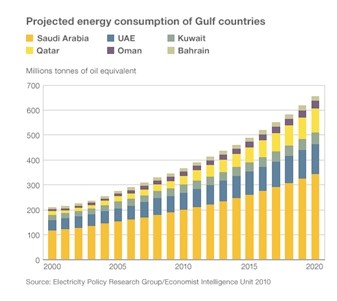

What is the rationale behind this statement? Prima facie, it seems surprising that despite being endowed with some of the largest energy reserves in the world, and with top natural gas producers such as Iran and Qatar in the immediate neighborhood, the UAE would look to the U.S. for natural gas supplies. The UAE has the second largest Arab economy and both the fifth largest proven oil and fourth largest proven natural gas reserves in the region. Proven natural gas reserves are estimated at 215 trillion cubic feet. However, since most of the natural gas produced is associated with oil – so-called “associated gas” – natural gas availability is dependent on the production of crude oil for export. Unsurprisingly, rapidly rising energy consumption coupled with slow production growth made the UAE a net natural gas importer since 2008.

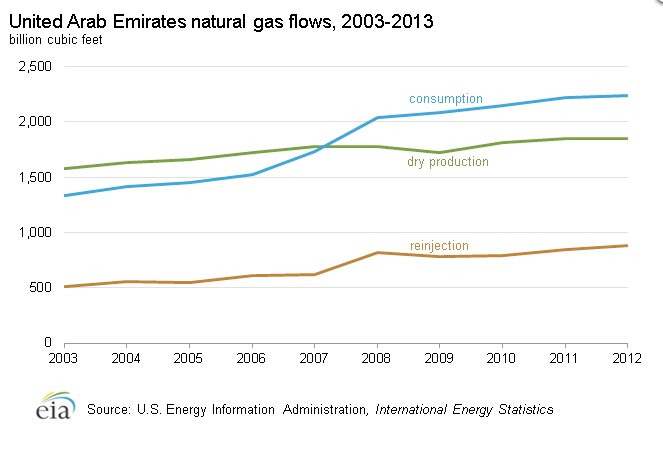

According to the EIA, the UAE was the first country in the Middle East to export liquefied natural gas (LNG), and has exported more than 250 billion cubic feet of LNG annually, predominantly to Asia. The tides are turning now and the UAE seems to have become the ‘victim’ of its own economic success. A statement by an IMF official after a recent visit to the country confirms that as reported by the Khaleej Times: “Economic growth in the UAE is expected to remain strong. The economy is estimated to have grown by 4.5% in 2013, supported by tourism, hospitality and real estate. We expect real GDP growth to remain firm at 4.5% [in 2014].” This firm growth trajectory led to soaring energy consumption by its population as well as the growth of energy-intensive industries. Moreover, the UAE re-injected around 26% of gross natural gas production from 2003 to 2012 into its mature oil fields to boost production levels and exploit the known reservoirs more efficiently. Here, the objective was clearly to free up additional volumes of crude oil for export to the high-priced global oil market. The UAE is, therefore, also pursuing a diversification strategy by adding nuclear and renewable power generation capacity.

Nevertheless, its dependence on natural gas for domestic needs is not going away in the short or medium term. This projection is substantiated by energy investments made by the Abu Dhabi Government investment vehicle Mubadala. The most recent investment is the so-called ‘Emirates LNG’ project in 2013 that was formed to secure additional natural gas supplies in order to meet steadily growing energy demand. Part of this project is the construction of a new LNG regasification facility on the UAE’s east coast (Gulf of Oman) in the port city of Fujairah. Upon completion, Mubadala expects the import facility to supply a maximum of 1.2 billion cubic feet of natural gas per day, used primarily for power generation. In this respect, the expansion of the port of Fujairah is very interesting and may result in it becoming a major energy hub going forward. Most importantly, its location ensures that the UAE does not rely on free passage through the Strait of Hormuz for its energy needs – a move that shows the UAE government’s strategic foresight.

UAE Energy Infrastructure

Gulf Petrochem describes the location as follows:

“Fujairah is strategically located outside the Strait of Hormuz, 65 miles from the strait and on the open sea of the Arabian Gulf and the Indian Ocean. The region is highly safe in the time of war crisis or threats of war and totally free of piracy risks. Being in the international shipping route, almost 40,000 ships annually pass to and from the gulf.”

In addition, the port is strategically situated between India – the major energy demand center of the future – and East Africa with both Tanzania and Mozambique – two major potential future coal and natural gas (LNG) exporters. It is also one of the largest bunkering ports in the world behind Rotterdam and Singapore and it has the potential to develop as a deep-sea port. Currently, Khor Fakkan (Sharjah, UAE) is the only natural deep-sea port in the region. Fujairah could follow Singapore’s lead and build up its LNG storage capacity with a dual-purpose in mind; namely, to satisfy domestic energy needs and help limit natural gas price volatility for LNG importers. In this respect, it could attract Asian investments and perhaps even a Qatari investment to price high-cost global LNG projects out of the future LNG market and keep competitors at bay. Note, Qatar is still the low-cost LNG producer in relative terms due to its first-mover advantage in the LNG market. In this scenario, Fujairah would be build up as a second major new LNG storage center after Singapore. Given that both ports are located along the major international seaborne energy trading routes across the Indian Ocean to Asia, this could bring together and narrow regionalized natural gas pricing. Understandably, with Asian natural gas prices for LNG delivery in Northeast Asia potentially ticking lower, not all LNG export candidates – current and potential – would like to see that happen.

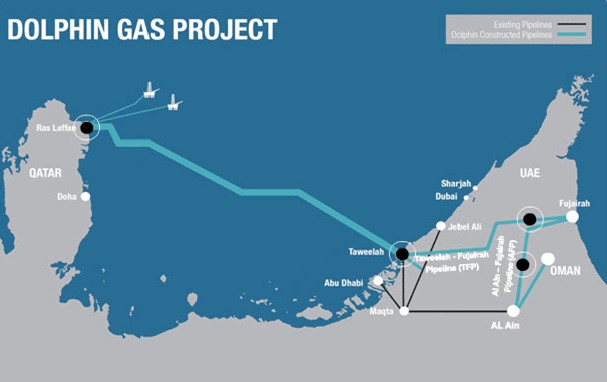

Another natural gas project pursued by Mubadala was the Dolphin pipeline. The first gas began flowing through the Dolphin pipeline across the Arabian Gulf in July 2007. According to the EIA, the Dolphin Pipeline currently has a capacity of approximately 2 billion cubic feet per day and transported 1.9 billion cubic feet per day in 2012, according to data by the operator Dolphin Energy Limited (DEL).

The UAE received approximately 1.7 billion cubic feet per day in 2012 with the remainder supplying neighboring Oman. Most importantly, DEL plans – according to the EIA – to expand the pipeline’s capacity to 3.2 billion cubic feet per day, full design capacity, in 2015. With its current capacity the pipeline is meeting only 30% of the UAE’s energy requirement on a daily basis. The problem with this supply route is that bilateral tensions between Qatar and the UAE have risen in recent years. The Financial Times points out that tensions came to a head in Egypt when Egypt’s military removed the country’s first democratically elected president “after Doha promoted Islamist groups during the unrest of the Arab spring.” Saudi Arabia and the UAE backed the military ouster of elected Muslim Brotherhood government of Mohamed Morsi, while Morsi had been supported by Qatar. Therefore, it’s no surprise that the UAE is wary of depending on Qatar for natural gas supplies because of regional rivalries, in addition to price disagreements with Qatar. As such, until new US LNG capacity reaches international markets after 2015, countries that need additional cargoes on short notice can only turn to the Qataris. Once the US joins the global LNG market as ‘new low-cost’ producer, it makes sense for countries like the UAE to keep their natural gas supply options open. It may even serve US national security interests to build up strategic LNG storage capacity for potential spot cargo deliveries to allies.