Imitation the highest form of flattery

Being big, as everyone knows, does not necessarily equate to being profitable or valuable. Yet, the valuation that investors place on companies, as measured in market capitalization – number of outstanding shares times price per share – is sometimes short of stunning, especially for start-up companies few have even heard of.

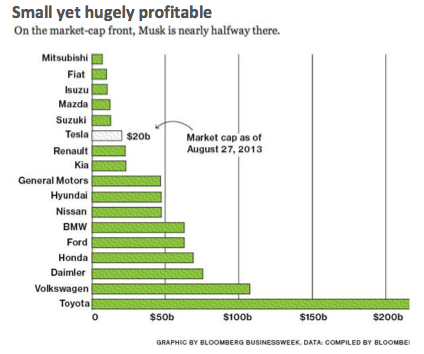

The electric car-maker Tesla, whose share price has risen nearly 400% this year alone, is now worth a stunning $20 billion, more than Fiat. Its current sales are less than 1% of Ford, but the company is worth nearly 1/3rd as much. Its $70,000 Model S is now the third-best-selling luxury sedan in California – outselling well-known brands including Porsche, Volvo, Lincoln, Land Rover and Jaguar in the state – that is if you are lucky enough to find one.

Stunned by the stratospheric rise of Tesla, General Motors Co., Volkswagen AG and other major auto makers have announced plans of their own to develop battery powered cars that can go 200 miles or more on a single charge. GM recently announced it will have a car on the market for around $30,000 to compete against Tesla. Imitation, as everyone knows, is the highest form of flattery.