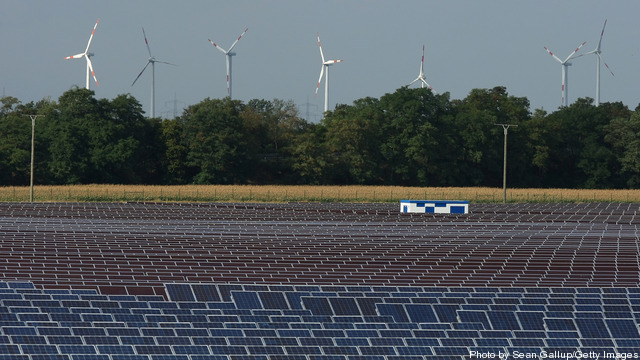

While Germany’s once soaring photovoltaic sector is going through very hard times – a consequence primarily of cheap Chinese imports – the country’s wind energy sector, also a market leader, has so far managed to stay on its feet. But the industry is not booming like it did just a few years ago and is scaling back its expectations for 2012. Experts in Germany say that the German wind industry should expect even tougher competition coming its way soon, possibly from China.

In Germany one of the country’s solar panel manufacturers after another closed their doors over the past year and a half: Battling with China and other new competitors the world-wide industry created a glut and prices went tumbling down in 2009 and 2010. With them went under what had been several of the choicest success stories of Germany’s post-unification economy, many of them in the former eastern Germany which had benefited immensely from the upstart renewables industry.

The country’s wind industry has been spared this severe fate, at least for now.

“PV is a different kind of a market,” explains Sven Kirrmann of Germany’s Renewable Energies Agency. “Its products are not so technologically complicated as the wind sector’s and thus it loans itself to mass production. China’s not quite up to the German or European level yet on wind turbine technology. But that could change.” He also points out that wind power involves much more maintenance than solar modules, and that the German firms provide a high quality of maintenance. “This is something the Chinese manufacturers can’t offer at the moment,” he says.

Germany is Europe’s leading wind turbine manufacturer, currently third in the global market behind China and the US. (Germany is also the world’s third largest user of wind power, behind China and US.) The sector’s revenues, which boomed from 2003 to 2008, have since 2009 sunk by a quarter, according to a recent study by the consulting firm Oliver Wyman, even though 2011 logged modest gains.

“The German wind power lobby has been pretty successful,” explains Joachim Müller-Soares, editor of the German business magazine BIZZ Energy Today. “This lobby learned its job partly from the US, how to network, how to represent its clients in the political and business arena, and in general how to make a name for itself. This kind of lobby effort was new thing for us in the 1990s but they have caught on – and do their business effectively.”

Read more about the German wind industry’s lobbying group in a profile here.

In 2011, Germany’s onshore wind sector lead the nation’s renewables field with 33% of the market share and an annual turnover of 8.16 billion euros, up 7% from 2010. Last year offshore wind provided 92,500 jobs in Germany, compared to 89,200 in 2010.

Meanwhile, the offshore sector had just 3 percent of the market and a turnover of 750 million euros. It accounted for 8600 jobs last year, 1700 jobs more than in 2010. In total, Germany’s renewable energy sector provided 381,000 domestic jobs last year, according to the Federal Ministry for the Environment (BMU).

The Export Equation

Exports comprise around 66 percent of total German wind industry output, according to Germany Trade & Invest, Germany’s foreign trade and inward investment agency.

Domestic wind power expansion in Germany (1,977 MW) meant that 2011 was a relatively successful year for the German onshore wind industry even though the euro crisis triggered a decline in the EU market. According to the BMU, “the expansion in international production facilities means that Germany’s exports to other regions of the world are no longer rising as steeply.” As for offshore wind power, the opposite was true: German companies’ export success in the European market led to a rise in turnover of 27%.

Germany’s wind industry faces two major obstacles in addition to more rigorous competition: a likely revamping of Germany’s renewable energy law, which provides key incentives for clean energy investment, as well as the slow pace of Germany’s offshore expansion, caused by logistic and financial challenges.

The fact that German industry still thinks wind is a good bet is reflected in Siemens recent decision to divest of solar energy holdings but keep wind and hydro. The CEO of its energy sector, Michael Süß, told Bloomberg Energy that, “the importance of renewable energies in the global power mix will continue to grow and hydro power and wind energy will remain the major renewable contributors. Our renewable energy activities will be focused on these two areas.”

According to Süß, Siemens is an established “clear market leader for offshore wind power farms” and said the company is “making good progress in onshore business.”

The Oliver Wyman study concluded that Germany had to do four things to keep its edge in the wind power market: internationalization, cost reduction, efficiency, and service. The study argued that an increased focus on the service and maintenance business could even increase the profit margins of Germany’s wind turbine manufacturers.

While the German wind sector’s outlook depends substantially on the development of its own offshore potential, it is unlikely that the industry will experience a return to the halcyon days of the mid-2000s when it lead the market with little competition to test it. China has taken over the lead of the market not by exporting but rather by supplying its own domestic demand. Though few observers see Chinese competition in wind surging like it did in the PV branch, it is likely to be a factor in the future.

“We’ll see a Chinese turbine here in Germany within the next five years, “says Wiedemann of BIZZ Energy Today. “And maybe a few German bankruptcies, too.”

This piece appears on Breaking Energy as part of the Energy Transparency series in partnership with Vestas.