The US utility industry will look fundamentally different within the next forty years as a paradigm shift transforms the sector, the chief of one of the country’s largest energy providers said.

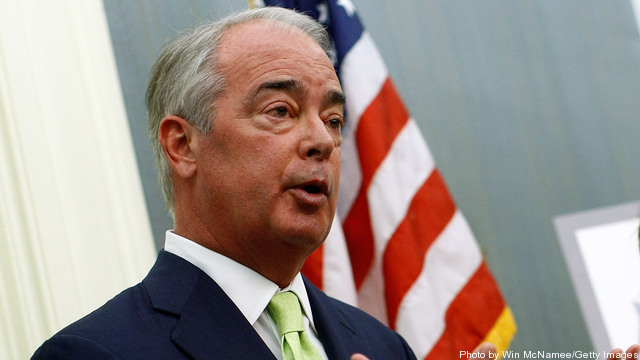

“We’re going to reinvent our business, we’re going to adopt new technologies,” said Jim Rogers, Duke Energy CEO. “When you look at our company four decades from now it will to look fundamentally different.

“We have a blank sheet of paper to design what future energy generation fleet will become in the future … [and] we’re going to have to rethink the grid in a different way.”

He said that the company had looked at 700 technologies over last 4 years and selected 27 pilot projects in its own system and has partnerships with 63 pilots the company in the US.

Speaking at the Hamilton Project Forum on energy at Stanford University, he said: “I believe our business will go from being a kilowatt hour seller of electricity but to more of an optimiser of the grid.

“The model I see is one of optimisation [in] deploying capital in homes and businesses and deploying distributed generation [such as solar] in the areas we serve.”

Cybersecurity A Threat to Centralization

Rogers also said that centralized models of energy generation and distribution would have to

change to avoid threat of cyber-attack and that the smart grid was “a concept that’s been oversold and overhyped and turned out to be an impediment to development of new technology.”

The Federal Energy Regulatory Commission last week conditionally approved Duke Energy’s merger with Progress Energy in a $26 billion all-stock deal. The merger would create the largest utility company in the US with a generating capacity of 57 GW and seven million customers in North and South Carolina, Florida, Indiana, Ohio and Kentucky.

As of 2010, Duke’s generation fleet was 48% coal-fired, with some of the plants dating back to the early part of the 20th century. Under new Environmental Protection Agency (EPA) regulations, Duke Energy plans to retire 2,773MW of older coal-fired generation by 2015 in addition to the retirement of 1,027MW of capacity in 2011 and early 2012.

Duke Energy now dispatches its coal fleet after all its other sources of generation, said Rogers.

“Today we’re dispatching hydro first, then our nuclear, then natural gas before our even our most efficient coal plants. Gas prices have to go above $4.25 per mmbtu before we start dispatching our most efficient coal.”

Getting Ahead of Cleantech

As the grid transitions away from coal, Rogers said his company would not stand in the way of progressive action to supply the US electric grid with cleaner sources of energy.

“We’re not going to be one of these incumbents that fights it, we’re going to get ahead of it. When a parade forms on an issue you can throw your body in front of it and let them walk over you or you can jump in front of the parade and pretend it’s yours.”

But he said that the strength of the US electric grid was the diversity in its energy portfolio and while it was tempting to build combined-cycle gas fired power stations because of low natural gas prices, to build gas-only would be a mistake.

To pick up on Ben Franklin, who said there were two things that are certain in life: death and taxes. I would add the volatility of natural gas prices.” – Rogers

“The strength today of the electric system in America that we have a portfolio of ways to generate electricity. My number one fear is that we will be forced to build gas and push out solar [which] will trump wind because of its distributed nature.

“We have to resist the temptation as we retire and replace existing generation to build nothing but natural gas. That would be a mistake.”

Global Gas

A policy paper published this month by the Hamilton Project on the strategy for US natural gas pointed to increasing pressure to export natural gas into the global market. Spot prices in 2012 fell below $2 per 1,000 cubic feet, whereas gas traded at $11 in Europe and over $15 in Asia.

Exports and diversification of demand could drive US domestic prices upwards, said Kenneth A Hersh, CEO of NGP Energy Capital Management.

“Price relationships such as oil versus gas can change and they wildly change. In the late 1970s we were implementing law that said we should not use natural gas for power generation in this country because it’s too vital.

“If 10% cars ran on natural gas we’d use 20% of the US natural gas supply. Don’t think that the price of natural gas would stay low. Understanding the full cycle of movements you can’t rely on the [price] relationship. It’s a commodity.”

Rogers also said that focus on a single fuel as had happened in transportation would be problematic in the future. Policy decisions based on fossil fuel prices and forecast supply by previous administrations decades ago had left today’s energy industry with huge legacy burdens, which would make a carbon tax unfair.

“There is an inherent unfairness to a carbon tax. There are 25 states in this country where more than 50% of the electricity comes from coal. Why is there so much coal in the states? In 1978, 18% of electricity in this country was coming from oil and we were told by the government go build coal and nuclear because that’s the future.”

A cap and trade system would be a fairer, he said, adding that utilities needed to anticipate future policies, such as a price on carbon.

“I know there will be some price on carbon in the next four years. I factor in a carbon price into every decision on what I build. That’s the only prudent way for me to make these longer-term investments.”