The solar industry is changing as it grows, providing a rare opportunity to see an evolving market at work.

For those firms facing bankruptcies and operational problems, the change can seem daunting, but for firms backed by significant balance sheets and buoyed by robust development pipelines, the changes only highlight the opportunities.

“From our standpoint, grid parity [for solar power] is now in sight,” Recurrent Energy CEO Arno Harris told Breaking Energy recently. The idea that solar power can compete on a cost basis with traditional fuels like natural gas or coal has been widely forecast, but the devil remains in the details as those incumbent fuels enjoy advantages in full capitalized power plants and incumbent access to transmission and financing.

That means playing in markets that have two elements, Harris says: Liberalized energy markets and a fair amount of sun.

The firm has roughly 500 MW of contracted solar power representing $1.6 billion of business, with a pipeline of roughly 2 GW of new solar power representing part of what Harris calls an “accelerating wave of adoption that will transform the solar industry.”

“From our standpoint, grid parity [for solar power] is now in sight,” Recurrent Energy CEO Arno Harris (CHK) told Breaking Energy.

Taking advantage of those opportunities requires access to financing, and that underpinned Recurrent Energy’s decision to sell to Sharp in September 2010. The firm calls itself the global solar development company for Sharp, but in many ways it remains an independent firm, sharing one board member with the electronics giant.

Recurrent Energy is different from the solar firms that have sought bankruptcy protection in recent weeks, relying on conventional solar photovoltaic technology rather than riskier new technologies, and acting as a project developer. The firm specializes in the large-scale solar popular with utilities trying to meet renewable portfolio standards, and has been able to take advantage of rapidly falling prices for conventional panel components in recent years.

For Recurrent Energy, a distributed generation solar project means a 10-20 MW project rather than a rooftop, but Harris says that choosing between residential distributed solar and centralized utility-scale solar is a false dichotomy for the industry.

“It is a false choice,” Harris says, emphasizing that there is a future for both small and large-scale solar. The large-scale requires a different set of skills for project developers, as permitting takes longer and access to transmission can be challenging.

Access Aspirations

Access to transmission is a major issue for solar power companies, and one that needs addressing by regulators and governments before the industry can dial up hiring and create the “green energy” jobs politicians have pushed over the past decade.

The two sets of rules at public utility commissions and at independent system operators, both charged with transmission planning, pricing and reliability responsibilities, have confounded efforts to prioritize transmission planning for renewable projects like solar.

“A lot of projects are dependent on transmission upgrades,” Harris said, and there have been difficulty getting prioritization in the interconnection queue to match project completion deadlines.

Policy Peculiarities

Harris is also wary of the US government’s role in funding some of his competitors. Policies that create markets are being superseded by policies that attempt to choose winner and losers, an approach that carries immense liability.

Taxpayers and the government are not used to playing a venture capital role, Harris said in reference to controversy surrounding recent bankruptcies at solar companies with federal loan guarantees. Recurrent Energy uses commercially established technology and won’t be impacted by any changes to the loan guarantee program, Harris said, adding that he would be “curious” about the impact of the recent industry turmoil on the Department of Energy loan guarantee program.

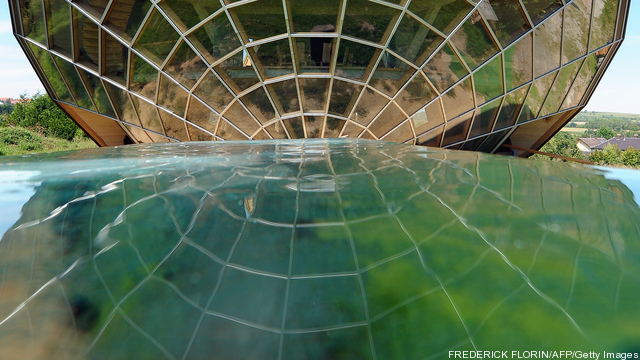

Photo Caption: A solar heliodrome array in France that looks like a wave.